Kryptowährung investment has gained significant popularity in recent years. As the world becomes more digitized, cryptocurrencies offer a dezentral way to conduct transactions securely and provide potential for hoch returns. However, navigating the world of cryptocurrencies can be overwhelming, especially for beginners. This comprehensive guide aims to provide you with an overview of different types of cryptocurrencies, investment strategies, and how to mitigate risks.

Types of Cryptocurrencies

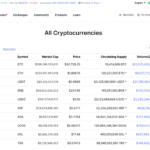

Cryptocurrencies vary significantly in terms of their functionality, underlying technology, and purpose. Some of the most popular cryptocurrencies include:

| Kryptowährung | Definitive Merkmale |

|---|---|

| Bitcoin (BTC) | First decentralized cryptocurrency; widely accepted as a digitale Währung |

| Ethereum (ETH) | Blockchain-based platform enabling development of smart contracts and decentralized applications |

| Ripple (XRP) | Designed for faster, low-cost international Geld transfers |

| Litecoin (LTC) | Based on Bitcoin’s open-source technology, but with faster transaction confirmation times |

Investment Strategies

Investing in cryptocurrencies requires careful planning and consideration. Here are some popular investment strategies:

- Buy and Hold: Purchasing cryptocurrencies and holding them for an extended period, with the belief that their value will increase.

- Day Trading: Taking advantage of short-term price fluctuations and making regular trades within a day.

- Diversifizierung: Spreading your investments across multiple cryptocurrencies to minimize risk.

- ICO Investments: Investing in Initial Münze Offerings, which are similar to IPOs but for cryptocurrencies.

How to Mitigate Risks

While cryptocurrencies offer potential for high returns, they also come with certain risks. Here are some strategies to mitigate those risks:

- Do Your Research: Thoroughly understand the cryptocurrency you plan to invest in and its market dynamics.

- Stay Updated: Stay informed about regulatory changes and technological advancements in the cryptocurrency space.

- Invest What You Can Afford to Lose: Do not invest more money than you can afford to lose, as the cryptocurrency market can be highly volatile.

- Secure Your Investments: Use secure Geldbörsen and follow best practices to protect your funds from hacking and theft.

FAQs

1. Is investing in cryptocurrencies risky?

Yes, investing in cryptocurrencies can be risky. The cryptocurrency market is highly volatile, and the value of your investments can fluctuate significantly.

2. Which cryptocurrency should I invest in?

Choosing the right cryptocurrency to invest in depends on various factors, including your risk tolerance, investment goals, and research about the specific cryptocurrency.

3. How can I store my cryptocurrencies securely?

You can store your cryptocurrencies securely by using hardware wallets or secure software wallets. Additionally, make sure to follow best practices such as using strong passwords and enabling two-factor authentication.

Schlussfolgerung

Cryptocurrency investment can be a lucrative endeavor, but it requires careful planning, research, and risk mitigation strategies. By understanding the different types of cryptocurrencies, investment strategies, and how to mitigate risks, you can make informed investment decisions and navigate the cryptocurrency market with confidence.