Main Highlights or Features

– Commission-free trading for stocks, options, and ETFs

– User-friendly platform with a sleek and intuitive interface

– Access to a wide range of investment options including cryptocurrencies

– Fractional shares allow users to invest in high-priced stocks with smaller amounts of money

– No account minimums, making it accessible for all types of investors

– Robust mobile app for on-the-go trading

Comparison Table of Robinhood vs alternatives

Here is a comparative table of Robinhood and some of its alternatives:

| Brokerage | Key Features | Account Minimum | Fees | Unique Selling Points |

|---|---|---|---|---|

| Robinhood | Stock, ETF, Options, Cryptocurrency trading, Fractional shares | $0 | $0 (0 commission trading) | User-friendly platform, free trading of stocks, ETFs, options and crypto |

| TD Ameritrade | Stock, ETF, Options, Futures, Forex, Cryptocurrency trading, Extensive research and tools | $0 | $0 stock trades, Options are $0.65 per contract | Excellent customer service, large range of investment options, extensive research |

| Fidelity | Stock, ETF, Options, Mutual fund trading, Extensive research and tools, Fractional shares | $0 | $0 stock trades, Options are $0.65 per contract | Wide array of investment options, robust research tools, advanced trading platform |

| E*TRADE | Stock, ETF, Options, Futures, Mutual fund trading, Extensive research and tools | $0 | $0 stock trades, Options are $0.65 per contract | Extensive resources for education, free analyst research, multiple trading platforms |

| Webull | Stock, ETF, Options, Cryptocurrency trading, Extended trading hours, Fractional shares | $0 | $0 (0 commission trading) | Intuitive platform, advanced charting features, free trading of stocks, ETFs, options and crypto |

These are just a few alternatives to Robinhood. Each one has its own set of strengths and may appeal to different types of investors. For example, TD Ameritrade and Fidelity offer more advanced tools and a wider range of investment options, which may be more appealing to experienced investors, while Webull offers similar features to Robinhood but with additional technical analysis tools. As always, it’s important to do your own research before deciding on a brokerage.

Summary Table

| Features | Rating |

|---|---|

| Commission Fees | 5/5 |

| Account Minimum | 5/5 |

| Investment Options | 4/5 |

| User Interface | 5/5 |

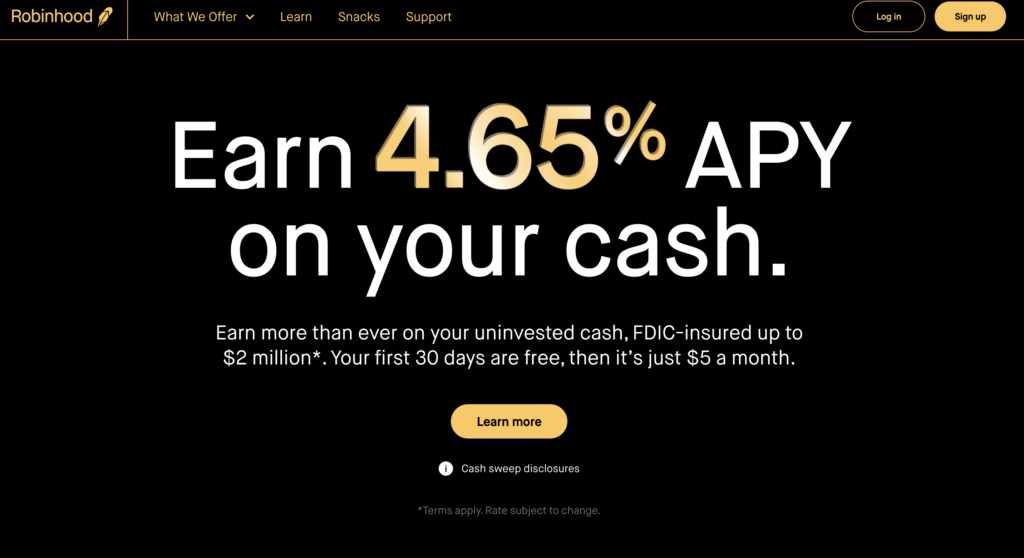

Fees and Pricing Structure

– Robinhood offers commission-free trading for stocks, options, and ETFs.

– Cryptocurrency trading also incurs no fees.

– However, margin trading and access to premium features, such as Level II market data, come at additional costs.

Minimum Deposits

– There is no minimum deposit required to open an account on Robinhood, making it suitable for both experienced and beginner investors.

Safety Features

– Robinhood is a member of FINRA and provides SIPC protection for up to $500,000 in cash and securities per account.

– The platform also employs SSL encryption to protect users’ personal and financial data.

FAQs

1. Can I trade options on Robinhood?

– Yes, Robinhood offers options trading for users.

2. What is the process of opening an account?

– Opening an account on Robinhood is simple and requires filling out an online application. Verification may be needed for trading options or margin.

3. Are my funds safe with Robinhood?

– Robinhood is a registered brokerage and is committed to keeping funds secure. SIPC protection is also provided.

Conclusion

Overall, Robinhood excels in providing commission-free trading, a user-friendly platform, and accessibility for all types of investors with no minimum deposits. While the investment options are not as extensive as some competitors, the added features like fractional shares and cryptocurrency trading make it an attractive option for many. Additionally, the safety measures in place give users peace of mind when it comes to protecting their investments.