Main Highlights or Features

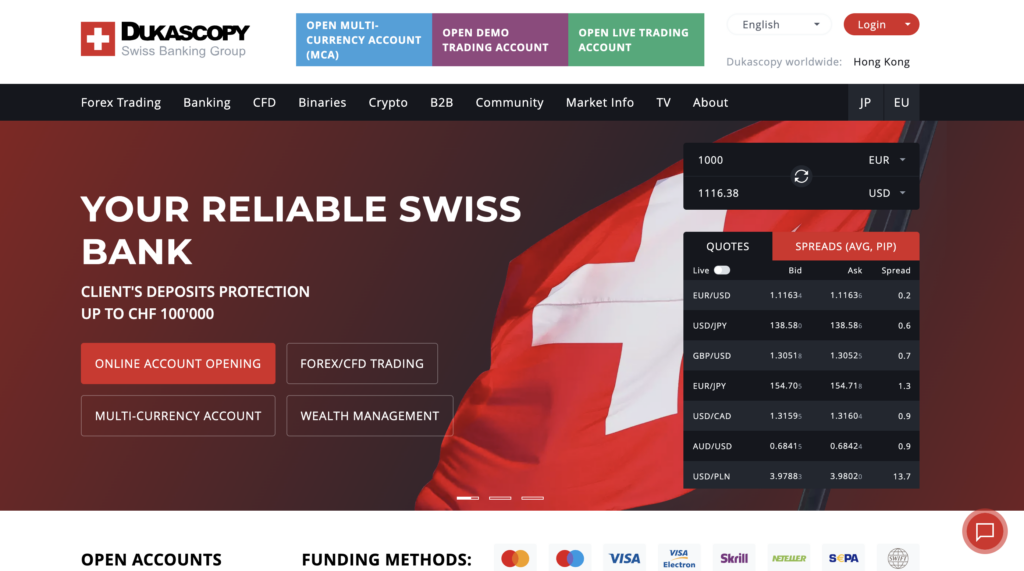

Dukascopy is a leading forex broker offering a wide range of features that caters to both beginner and experienced traders. Here are some of the main highlights of Dukascopy:

– Advanced Trading Platform: Dukascopy provides a unique trading platform called JForex, which offers powerful trading tools and features. The platform is highly customizable and user-friendly, providing traders with a seamless trading experience.

– Wide Range of Tradable Instruments: Dukascopy offers a diverse range of tradable instruments, including Forex, commodities, indices, cryptocurrencies, and stocks. This allows traders to diversify their portfolios and take advantage of various market opportunities.

– Competitive Spreads and Execution: Dukascopy provides tight spreads and fast execution, ensuring that traders can enter and exit positions quickly at the best available prices. The broker also uses advanced technology to reduce slippage and provide competitive trading conditions.

– Transparent Pricing and Execution: Dukascopy operates on the Swiss Foreign Exchange Marketplace (SWFX), which ensures fair, transparent, and direct pricing for traders. The broker also provides detailed trade reports and comprehensive trading statistics to users, promoting transparency and accountability.

– Robust Risk Management Tools: Dukascopy offers various risk management tools, such as stop loss orders and guaranteed stop loss orders, to help traders limit their potential losses. These tools provide an added layer of protection and help traders manage their risk effectively.

Comparison Table

Here’s a comparison table of Dukascopy with GBE Brokers, Capital Index, and Plus500 based on certain criteria:

| Criteria | Dukascopy | GBE Brokers | Capital Index | Plus500 |

|---|---|---|---|---|

| Regulation | Regulated by FINMA (Switzerland) | Regulated by CySEC (Cyprus) | Regulated by FCA (UK) | Regulated by multiple authorities (FCA, CySEC, ASIC) |

| Trading Instruments | Forex, CFDs, Metals, Cryptocurrencies | Forex, CFDs, Indices, Commodities | Forex, CFDs, Indices, Commodities | Forex, CFDs, Cryptocurrencies, Stocks, Indices, Commodities |

| Minimum Deposit | $100 | $500 | £100 | $100 |

| Trading Platforms | JForex, MT4 Bridge | MetaTrader 4, GBE Brokers Trader | MetaTrader 4, Capital Index Trader | Plus500 WebTrader, Mobile App |

| Account Types | Individual, Joint, Corporate, VIP | Individual, Joint, Corporate | Individual, Joint | Individual, Joint |

| Commissions | Variable spreads, commission-based accounts available | Variable spreads, commission-based accounts available | Variable spreads, commission-free trading | Variable spreads, commission-free trading |

| Leverage | Up to 1:100 for Forex, up to 1:30 for CFDs | Up to 1:30 for Forex, up to 1:20 for CFDs | Up to 1:200 for Forex, up to 1:20 for CFDs | Up to 1:300 for Forex, up to 1:30 for other instruments |

| Demo Account | Available | Available | Available | Available |

| Education and Research | Educational resources, webinars, market analysis | Educational resources, video tutorials, market analysis | Educational resources, video tutorials, market analysis | Educational resources, demo tutorial, economic calendar |

| Customer Support | Email, phone, live chat | Email, phone, live chat | Email, phone | Email, phone, live chat |

| Additional Features | Automated trading, SWFX Sentiment Index, PAMM accounts | Social trading, Autochartist, VPS hosting | Price alerts, risk management tools | Price alerts, economic calendar, guaranteed stop orders |

Please note that the information provided is based on general knowledge and may be subject to change. It’s important to conduct your research and review the specific details of each broker before making a decision.

Summary of Review

Overall, Dukascopy is a highly reputable forex broker offering a wide range of features and tools to enhance the trading experience. With its advanced trading platform, diverse range of tradable instruments, competitive spreads, and transparent execution, the broker provides traders with a reliable and user-friendly platform for their forex trading needs. The robust risk management tools offered by Dukascopy further ensure that traders can effectively manage their risk while taking advantage of market opportunities.

Fees and Pricing Structure

Dukascopy offers several types of accounts, each with different fee structures and minimum deposits.

Here’s a table summarizing the different account types offered by Dukascopy:

| Account Type | Description |

|---|---|

| Standard Account | The Standard Account is a popular choice for individual traders. It offers access to a wide range of trading instruments, including forex, CFDs, metals, and cryptocurrencies. The account features variable spreads and the ability to trade micro-lots (0.01 lot size). There are no minimum deposit requirements for the Standard Account. |

| ECN Account | The ECN Account is designed for more advanced traders who require direct market access (DMA) and tighter spreads. It offers access to the SWFX marketplace, where traders can interact with liquidity providers. The ECN Account features variable spreads and allows trading with larger lot sizes. A minimum deposit of $100 is required to open an ECN Account. |

| Demo Account | Dukascopy provides a Demo Account option for traders who want to practice trading strategies or familiarize themselves with the trading platforms without risking real money. The Demo Account allows access to all the features and instruments available on the live accounts, enabling traders to simulate real market conditions. |

| Managed Account | Dukascopy offers Managed Accounts for clients who prefer to have their trading accounts managed by professional portfolio managers. With a Managed Account, the portfolio manager will make trading decisions on behalf of the client based on the agreed-upon investment strategy. Managed Accounts provide access to a team of experienced traders and customized investment solutions. |

| Institutional Account | Dukascopy provides Institutional Accounts for corporate clients, including banks, hedge funds, brokers, and other financial institutions. These accounts offer customized solutions, such as prime brokerage services, deep liquidity, and advanced trading technology, to meet the specific needs of institutional clients. |

Please note that the availability of account types and their specific features may be subject to change. It’s always recommended to refer to the official Dukascopy website or contact their customer support for the most accurate and up-to-date information regarding account types and their specifications.

Here’s a table summarizing the fee and pricing structure of Dukascopy:

| Fee / Pricing | Details |

|---|---|

| Commission | Dukascopy charges commissions on certain trading accounts, such as the “Standard” and “ECN” accounts. The commission rates vary depending on the account type and trading volume. They are typically calculated as a fixed amount per traded lot. |

| Spreads | Dukascopy offers variable spreads on its trading instruments, including forex, CFDs, metals, and cryptocurrencies. The spreads can vary depending on market conditions and liquidity. Typically, Dukascopy aims to provide tight spreads to its clients. |

| Overnight Financing | For positions held overnight, Dukascopy applies overnight financing charges or credits based on the interbank interest rates related to the currency pair being traded. These charges/credits are calculated based on the notional value of the position and the applicable interest rates. |

| Inactivity Fee | Dukascopy imposes an inactivity fee of $10 per month on accounts that have been inactive for more than 12 months. This fee is charged to maintain the account and cover administrative costs. |

| Deposit and Withdrawal Fees | Dukascopy generally does not charge any fees for depositing funds into trading accounts. However, there may be fees associated with specific payment methods or intermediary banks. Withdrawals from Dukascopy accounts may also incur fees depending on the withdrawal method and currency. |

| Data and Market Access | Dukascopy provides access to its trading platforms and market data free of charge for its clients. However, there may be fees associated with specific premium features, data packages, or API usage, which can be optional and depend on the client’s requirements. |

Please note that the fee and pricing structure may vary depending on the specific account type, trading volume, and other factors. It’s always recommended to refer to the official Dukascopy website or contact their customer support for the most accurate and up-to-date information on fees and pricing.

Safety Features

Dukascopy prioritizes the safety and security of its clients. Here are some safety features offered by the broker:

– Regulated: Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA), ensuring adherence to strict regulatory standards.

– Segregated Accounts: Client funds are held in segregated accounts, separate from the broker’s operational funds. This provides an extra layer of protection for traders.

– Deposit Insurance: Dukascopy offers a deposit insurance program, safeguarding client deposits up to CHF 100,000.

– Two-Factor Authentication: The broker provides the option for two-factor authentication, adding an extra security layer to client accounts.

FAQs

1. Is Dukascopy available for traders worldwide?

– Yes, Dukascopy accepts traders from various countries, although there may be certain restrictions depending on local regulations.

2. What is the minimum deposit required to open an account with Dukascopy?

– The minimum deposit varies based on the type of account chosen. For a Standard Account, the minimum deposit is $100.

3. Does Dukascopy offer demo accounts for practice trading?

– Yes, Dukascopy offers free demo accounts with virtual funds for traders to practice and familiarize themselves with the platform.

4. What trading platforms are available with Dukascopy?

– Dukascopy offers the JForex platform, which is a highly advanced and customizable trading platform. It is available for both desktop and mobile devices.

Conclusion

Dukascopy is a leading forex broker that stands out with its advanced trading platform, wide range of tradable instruments, competitive spreads, and transparent execution. With its robust risk management tools and strong commitment to client safety, Dukascopy provides traders with a reliable and secure platform for their forex trading needs. Whether you are a beginner or an experienced trader, Dukascopy offers the necessary tools and resources to enhance your trading experience.