Compound crypto, a decentralized financial protocol that is built on the Ethereum ecosystem, is called a “compound crypto”. Compound’s primary goal is to provide a platform for both crypto lenders and borrowers that allows them to make their digital money work and allow them to access loans without having to worry about regulators. It operates on smart contracts and is transparent and secure.

Let’s take a look at what this giant of the DeFi market can offer. We will discuss the fundamental principles of Compound and its use cases, as well as the basic features. Finally, we’ll talk about COMP cryptocurrency, the developers behind it, and how the Compound Finance platform impacts the crypto community.

What is Compound?

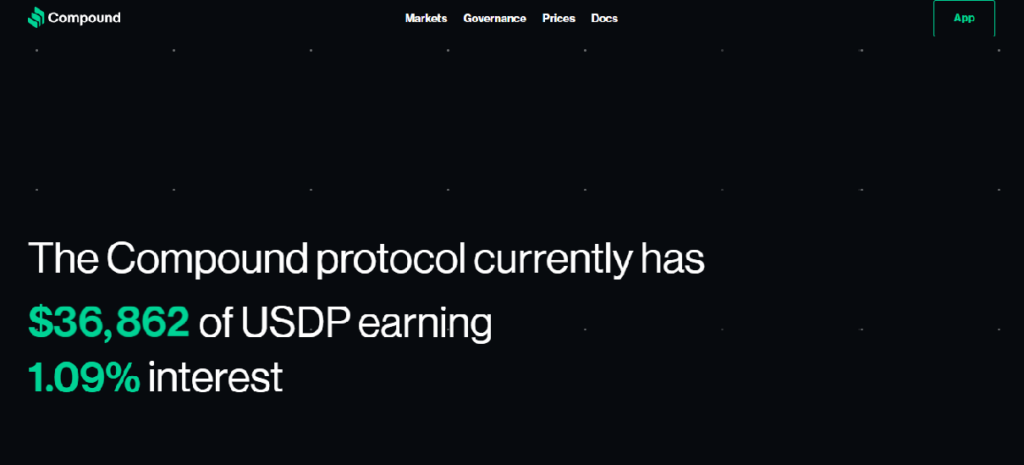

Compound (COMP), a decentralized protocol, provides lending services via its yield farming features. It was founded in 2017 by Robert Leshner (CEO Compound), and Geoffrey Hayes, (CTO Compound).

Compound Finance allows its users to trade, save, and use the asset in other DeFi apps. Smart contracts are used to lock up collaterals, while the market generates interest.

The governance token for the Compound protocol is the COMP token. The Compound protocol was made decentralized and centralized upon its release.

It was the first platform to bring the spotlight to yield farming on June 27, 2020. COMP is an ERC-20 token; these tokens can be accessed and developed in smart contracts using the Ethereum Blockchain.

ERC-20 was one of the most important Ethereum tokens and has since evolved to be the standard token for the Ethereum Blockchain.

The system is funded by liquidities that users supply to large borrowing groups. They receive tokens as a reward that they can use to convert any asset supported by the network. On a temporary basis, users can borrow assets from the network.

They will pay interest on each loan they take. This is split between the lender and the lending pool.

The yielding pools are similar to staking pools in that they reward users based upon how long they stay active and how much crypto they lock into the pool. The pooling system has a shorter borrowing period than the staking pool.

This protocol allows users to lend and borrow up to 9 ETH-based assets including Tether (wBTC), Wrapped BTC(wBTC), Basic Attention Tokens (BAT), USDT (USDT) and USD-Coins (USDC).

A Compound user can earn more than 25% annually at the time of this review. This is also known as APY (when lending the Basic Attention Tokens (BAT)). Compound does not have regulations such as Anti Money Laundering or Know Your Customer (KYC).

Users can also earn more than 100% APY due to the appreciation of the COMP token’s value.

How does Compound work?

Compound runs are made possible by the Ethereum blockchain. Smart contracts use smart contracts to track market trends and to assign interest rates to specific coins. There are no restrictions or regulations on lending, and there is an impressive APY for those who want to lend their coin. Interest rates are not fixed or agreed upon between the parties, unlike traditional banking. Compound uses an algorithm to determine the interest rate for a specific coin.

Defining of DeFi

Decentralized Finance makes it possible to access financial services without the need for third parties. It allows users to make financial transactions in a private, decentralized way over the internet.

DeFi makes it possible to conduct transactions like trading, saving, and lending. It allows you to perform all transactions that are possible in your local bank system, but without the need for a central system.

DeFi environments include cryptocurrencies, but not fiat currencies. Stablecoins, which are cryptocurrencies that can be pegged to fiat currencies values, are the only exceptions.

The Ethereum Blockchain is the basis of the vast majority (just like Compound) of DeFi applications.

Compound Tokens

cTokens

Compound makes use of cTokens for interest accrual and other functions. You can withdraw large amounts of lower-valued cTokens after depositing a certain amount. These tokens are based on the collateral coin’s value. You can purchase a greater amount of collateral assets with the same number of cTokens that you received initially. This is one way to earn compound interest on crypto.

COMP Coins

Comp is a governance currency. Every coin you own gives you the right to vote on Compound matters. Anybody who holds at least 1% of the coin supply, or convinces others that they should delegate their coins to him, can submit a proposal. Then, a period for voting begins. After the two-day wait period, implementation starts after a minimum number have been cast. The community may vote on future matters, such as coin buybacks and UI changes to app. Whatever the issue, any decision that needs to be made will be decided by a democratic vote. When you borrow or loan money, COMP is a form of interest. It’s also a high-value coin.

Compound Features and Use

Compound can be considered an alternative to traditional financial instrument platforms. The mechanics of Compound work are different.

First, no ID verification is required. It’s hard to imagine a bank giving a loan to someone who is not identified. Many crypto enthusiasts believe that DeFi is the way to a more transparent, accessible, fair, and open global financial system. Compound does not conduct KYC checks. There is no need to verify identity, sustainability or assess risk.

The Compound ecosystem has no lower lending or borrowing limits. You can also repay the loan at any time, without penalties or terms. You can withdraw assets that are locked at any time. Lenders get their interest every 15 seconds, or once a new Ethereum block has been generated.

Compounded users must ensure that their collateral’s value does not fall below the limit. This is relative to their loan. To secure repayment of the loan, the collateral must not fall below the minimum. However, even in such a situation, any Compound member may repay up to half of their debt and receive a proportional amount of collateral at a 5% discount.

Compound can be used to make interest money by storing crypto assets. The whitepaper will provide more details about the technical features of Compound.

Liquidity Mining in Compound

To induce both the borrower as well as the lender to use the Compound protocol, liquidity mining was suggested. Why is this? Slowly, if users aren’t active and available on the platform, the token will begin to decline.

This forecasted problem is solved by both the lender and borrower being rewarded with COMP tokens. It results in high liquidity and activity levels.

This reward is given in a smart contract. The COMP rewards are distributed based on a few factors, such as the number of participants and the interest rate. There are currently 2,313 COMP tokens available on the platform. These tokens can be split into equal amounts for lenders and borrowers.

MarkerDAO vs. Compound

Prior to Compound’s recent arrival, MarkerDAO was a well-known Ethereum-based DeFi project.

Like Compound, MarkerDAO allows users to borrow and lend crypto using BAT or wBTC. DAI, an ERC-20 stablecoin, can also be borrowed.

DAI is also pegged to the US Dollar. DAI differs from USDC or USDT because they are supported by central assets. However, DAI is decentralized and a cryptocurrency.

Similar to Compound, a borrower can’t borrow 100% of the Ethereum collateral amount that he/she has put down in DAI. Only 66.6% of USD value.

If one deposits $1000 in Ethereum equivalent, the person can withdraw 666 DAI to get a loan similar to Compound. However, users can only borrow DAI assets and the reserve factor cannot be changed.

Both platforms use yield farming. Users can borrow from MarkerDAO in order to invest in Compound or lend in Compound. This is because Compound has a greater chance of profitability. The most important differences between the two most well-known DeFi protocols are:

Compounded protocols offer users more incentives and higher interest rates.

MarkerDAO was created to support the DAI stablecoin.

Compound supports borrowing and lending more assets. In MarkerDAO there is only one. This gives Compound a greater advantage in terms of the yielding factor, which is the driving force behind these DeFi protocols.

Compound is also more user-friendly than MarkerDAO.

Compound Cryptocurrency

You cannot mine Compound (COMP), which is the native cryptocurrency of this network. You can only get COMP from the platform’s developers. This coin has a limited supply of 10 000 000 COMP.

Each day, 2880 COMP is distributed to protocol users proportionally to the amount of transactions made with that particular coin. Lenders and borrowers get half each. The reward is transferred to the user’s account as soon as they earn 0,001 COMP.

Comp tokens can also be used to enable community governance. There is always a vote when an important decision about the future of the platform must be made. Compound users with more than 100 000 COMP may submit their ideas. These ideas are then voted on by the entire COMP-holder community. After a three-day voting period, if the idea receives more than 400 000 votes it is sent to the Timelock smart contract, which can be implemented in just two days.

Conclusion

We found a few major flaws in the program that we were able to examine for our review. Although the system is generally secure, it is still possible for someone else to steal your information. This is in stark contrast to regular crypto trading’s complete anonymity. Although complete decentralization is an ideal goal, it is not something that the Compound team has yet achieved.

Compound’s features and future potential make it impossible to ignore. It is the best option for crypto liquidity. It also offers a new way to earn value for your cryptocurrency, from lending to compound interest. The COMP coin is a solid investment option, making the influence it gives even more valuable.

Although healthy skepticism can be justified, Compound cannot be saved by a government. It will die or live based on how much it gives DeFi traders. This is enough to give it a lot of credibility. Crypto enthusiasts should be open-minded and think about how they could profit from liquid cryptocurrency, or investing in the COMP coin.