CoinRabbit is a great option for crypto enthusiasts looking to expand their knowledge of decentralized finance.

As a cryptocurrency lending platform, it facilitates loans between investors. The loans can be used for any type of spending by the borrower, even further crypto investing.

Borrowers should be aware that loans may be canceled. Investors should be cautious as they may lose their funds. This is what CoinRabbit can do for you, whether you are a borrower or saver.

What is CoinRabbit?

CoinRabbit, a crypto lending platform, facilitates crypto loans. This company was founded in 2020 and aims to make cryptocurrency work as a traditional currency for both holders and lenders.

It was founded with this goal in mind. It aims to provide a platform for lenders to earn interest without losing their assets, and borrowers to take out loans without losing their collateral.

ChangeNow.io is the company’s partner for exchange services, and Guarda.com to provide asset protection services. CoinRabbit is the P2P forum’s “meat and potatoes”.

Sign up for CoinRabbit

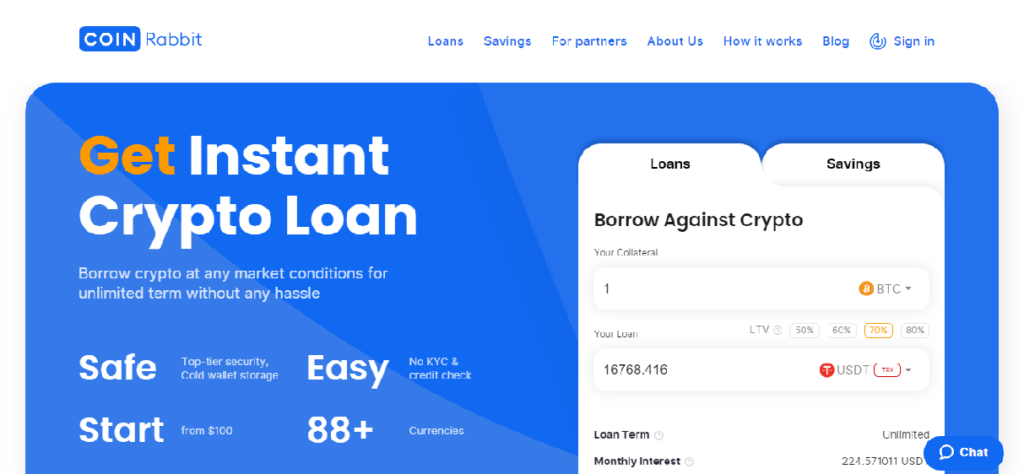

CoinRabbit is different from other crypto lending platforms. You don’t have to create an account before you can apply for a savings or loan. You can verify your contact information by sending an email or phone code.

It’s easy to create a CoinRabbit account thanks to the ease of access to the platform. However, as regulations are developed by federal and state governments for crypto lending platforms it is possible that you will need to verify your identity.

How does CoinRabbit’s crypto loan work?

CoinRabbit provides loans starting at $80 USDT for Bitcoin users, and $30 USDT for those using Ethereum or Bitcoin Cash. The lender does not have a maximum limit, unlike most crypto loan providers that we reviewed. This means that you can borrow whatever amount you like, provided you have the collateral.

It requires that you have a 50% loan to value (LTV), which means that you will need to put up twice the amount of your loan as collateral in order to be eligible. If you require a loan of $5,000, you will need $10,000 collateral. The loan term is unlimited, but there are $100 prepayment fees to pay off the loan in 30 days.

To ensure that your collateral doesn’t fall below the LTV margin of the lender, you will need to keep an eye on its value throughout the term.

Features

CoinRabbit Borrow

Let’s suppose you have 10 ETH Coins (that’s approximately $35,000 at the current rate). It is not your intention to sell it, but you know that Ethereum will continue to rise in value.

But, you had to do something. You need to spend $10,000 for an emergency. What are your options? To meet the demand, you could sell a portion of your ETH portfolio. What if Ethereum’s value rises right after you have sold off a portion of your portfolio? Oof! It won’t go down well. Trust me.

CoinRabbit steps in to save the day. You can use your ETH to secure a loan and then borrow the amount you have. The loan can then be used to pay for whatever you wish. You can return the loan with interest when you are ready and receive your ETH back. It’s that simple!

How to borrow cryptocurrency

It is easy to get a loan through CoinRabbit. No credit checks are required. Follow these steps to get started:

- Enter the amount of collateral that you have. This allows the system to determine how much you can borrow. This will be discussed in more detail later in the article.

- Confirm your decision with a phone number. The USDT or USDC payout address will be provided.

- Send the collateral to this address

- The loan should reach you in ten minutes

- Spend!

CoinRabbit Earn

You just sold a coin that you have held for a while and made a good profit. You are not ready to convert to fiat, but you have the stablecoin profit.

Instead of leaving your stablecoin inactive in your account you can put it down on CoinRabbit as a loan to borrowers. You’ll earn around 10% APY until you can use it. Plus, there’s more! There is no lockup period. You can withdraw at any time.

Fees

CoinRabbit claims that there are no fees. However, this is not true. Borrowers who borrow less than 30 days will be charged a $100 or equivalent token fee per loan.

It may also take a cut from a loan’s profit. Borrowers pay 14% APR for all loans. Investors are promised a 10% return on their coins. This leaves a gap of 4% which CoinRabbit can only assume it takes some.

CoinRabbit claims that it does not charge withdrawal fees. It is important to note that this crypto lending platform’s terms and conditions page states that investors who withdraw funds within three months will not only lose accrued interest but also have to pay all network fees.

How do I open a CoinRabbit Account?

On the CoinRabbit website, loans and interest accounts are available in a matter of minutes. The account authentication process at CoinRabbit is very simple. To open an account, users do not need a traditional account, where users must follow Know Your Customer laws. Instead, users will only need a phone line and a crypto address.

Safety and Security

CoinRabbit, like most crypto lending platforms, also secures your collateral and deposits in a Guarda cold wallet. This means that it is not connected to the Internet. Your private keys are stored in secure storage that can only be accessed by a VPN to a specified IP address. It claims that private keys are renewed monthly and use ChangeNow’s risk management system to monitor your balance every second.

Hacking is not the only threat to your collateral. This platform does not offer insurance for its wallet, and neither are crypto savings accounts or loans FDIC-insured.

While the lender may use a lot of security-focused language in their lending agreement, at the end you are giving the keys to your crypto to them for safekeeping. You risk losing your collateral if CoinRabbit or Guarda goes out of business.

Conclusion

CoinRabbit, a cryptocurrency lending platform and one of the most recent crypto lending platforms is available. Instant loans are available with no KYC and credit checks. You have a good chance to stay above liquidation waters because of its low LTV.

It is not regulated or audited, and it is still a relatively young player in the game. My advice: Start small if you want to get into crypto trading.