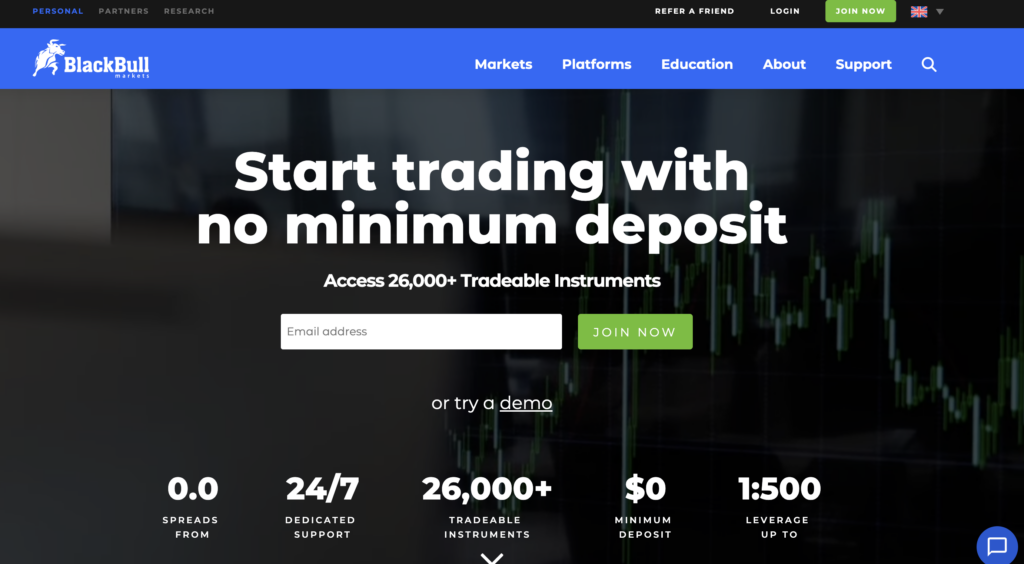

Main Highlights of BlackBull Markets

BlackBull Markets is a well-established forex and CFD broker that offers a range of trading options, including currency pairs, commodities, and indices. Here are some of the main highlights or features of this broker:

1. Wide Range of Tradable Instruments: BlackBull Markets provides a diverse selection of instruments to trade, including over 60 currency pairs, commodities such as gold and oil, and popular indices like the S&P 500 and NASDAQ.

2. Multiple Account Types: The broker offers various account types to cater to different trading needs, including a Standard Account, a Prime Account, and an Institutional Account. Each account type has its own set of features and benefits.

3. Competitive Spreads and Execution: BlackBull Markets prides itself on providing competitive spreads and fast execution for its traders. They offer tight spreads starting from as low as 0.1 pips, ensuring that traders get the best possible prices on their trades.

4. MetaTrader 4 Trading Platform: BlackBull Markets supports the popular MetaTrader 4 platform, which is known for its advanced charting tools, customizable interface, and automated trading capabilities. The platform is available for desktop, web, and mobile devices.

5. ECN Trading Environment: The broker operates as an ECN (Electronic Communication Network) broker, which means that traders have access to direct market liquidity and can enjoy faster trade execution with no requotes.

6. Dedicated Account Managers: BlackBull Markets provides dedicated account managers for each client, ensuring personalized attention and support throughout their trading journey. These account managers can assist with inquiries, provide market insights, and offer guidance.

Comparison Table: BlackBull Markets vs. Top Competitors

Let’s compare BlackBull Markets with two other similar platforms, FXCM and IG Markets.

| Features/Benefits | BlackBull Markets | FXCM | IG Markets |

|---|---|---|---|

| Regulatory Body | NZ Financial Markets Authority | UK’s FCA, multiple others globally | UK’s FCA, multiple others globally |

| Platform(s) | MetaTrader 4, MetaTrader 5 | Trading Station, MetaTrader 4, NinjaTrader | IG’s proprietary platform, MetaTrader 4 |

| Asset Classes | Forex, Commodities, Indices, Metals | Forex, Indices, Commodities, Crypto, Shares | Forex, Indices, Shares, Commodities, Crypto |

| Minimum Deposit | $200 (as per 2021) | Varies based on region and account type (generally no minimum for basic accounts) | £250 or equivalent (as per 2021) |

| Execution Type | ECN (Electronic Communication Network) | Market Maker, STP | Market Maker |

| Spreads | Starts from 0.1 pips | Starts from 1.3 pips | Starts from 0.6 pips |

| Maximum Leverage | Up to 1:500 | Varies based on region, up to 1:400 (for professional clients) | Varies by region, up to 1:200 for Forex |

| Demo Account | Yes | Yes | Yes |

| Customer Support | 24/6 | 24/5 | 24/5 |

| Education & Research | Yes | Yes | Yes |

Remember that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Summary Table: BlackBull Markets Review Highlights

Below is a basic summary of the key features and benefits of BlackBull Markets:

| Feature/Benefit | Description |

|---|---|

| Regulatory Compliance | BlackBull Markets is a registered financial services provider in New Zealand and is regulated by the New Zealand Financial Markets Authority (FMA). This gives traders a degree of protection and assurance of dealing with a legitimate broker. |

| Trading Platforms | BlackBull Markets provides access to the MetaTrader 4 and MetaTrader 5 platforms, which are widely recognized and used in the forex trading industry. They offer advanced charting tools, automated trading systems, and a user-friendly interface. |

| Asset Classes | Offers a variety of trading instruments, including Forex pairs, commodities, indices, and metals. |

| Account Types | Offers different account types to cater to different trading needs, including ECN Standard, ECN Prime, and ECN Institutional, with varying spreads, commissions, and minimum deposit requirements. |

| Execution Speed | Utilizes Equinix servers, which are known for high-speed order execution, reducing latency issues. |

| Customer Support | Provides 24/6 customer support via live chat, email, and phone, known for its responsiveness and helpfulness. |

| Education and Resources | Offers educational materials and resources for both beginners and experienced traders, including webinars, ebooks, and market analysis. |

| Leverage | Offers high leverage up to 1:500, depending on the account type and regulatory jurisdiction. |

| Pricing Transparency | Claims to offer true ECN (Electronic Communication Network) pricing with no dealing desk intervention, providing traders with direct access to liquidity providers. |

Please note that trading Forex and CFDs involves significant risk and can result in the loss of your invested capital. Always ensure that you fully understand the risks involved and seek independent advice if necessary.

Fees and Pricing Structure for Different Types of Accounts

BlackBull Markets offers different types of accounts, each with its own fee structure. Here are the details:

1. Standard Account: The Standard Account has no commission fees, and the spreads start from 0.8 pips.

2. Prime Account: The Prime Account has a commission of $6 per standard lot traded, and the spreads start from 0.1 pips. This account type is suitable for active traders looking for tighter spreads and lower trading costs.

3. Institutional Account: The Institutional Account is designed for professional traders and institutions. The fees and pricing structure are tailored to individual needs, and traders can reach out to BlackBull Markets for more information.

Minimum Deposits

For the Standard Account and Prime Account, the minimum deposit requirement is $200. However, for the Institutional Account, the minimum deposit requirement is higher and may vary based on the specific needs of the trader.

Safety Features

BlackBull Markets prioritizes the safety and security of client funds. Here are some of the safety features provided by the broker:

1. Segregated Client Accounts: Client funds are kept in separate accounts from the company’s operating funds, ensuring that client funds are protected in the event of insolvency.

2. Regulatory Compliance: BlackBull Markets is regulated by the Financial Markets Authority (FMA) in New Zealand, which imposes stringent requirements on financial service providers to safeguard client funds.

3. SSL Encryption: The broker utilizes SSL encryption on its website and trading platforms to ensure secure communication and protect sensitive client information.

FAQs

1. Is BlackBull Markets regulated?

– Yes, BlackBull Markets is regulated by the Financial Markets Authority (FMA) in New Zealand.

2. Can I trade cryptocurrencies with BlackBull Markets?

– No, currently BlackBull Markets does not offer trading in cryptocurrencies.

3. What is the minimum deposit required to open an account?

– The minimum deposit for a Standard or Prime Account is $200.

4. Can I use Expert Advisors (EAs) on the MetaTrader 4 platform?

– Yes, BlackBull Markets supports the use of Expert Advisors (EAs) on the MetaTrader 4 platform.

Conclusion

In conclusion, BlackBull Markets offers a comprehensive trading experience for both beginner and experienced traders. With a wide range of tradable instruments, competitive spreads, fast execution, and dedicated account managers, the broker aims to provide a top-tier trading environment. The choice of MetaTrader 4 as the trading platform ensures a user-friendly and feature-rich experience. Additionally, the broker’s adherence to regulatory standards and commitment to the safety of client funds further enhances its credibility.