Cryptocurrency, a digital or virtual form of currency, has taken the world by storm. In this article, we will provide a brief history of cryptocurrency and explore its growth and impact over the years.

The Origins

The concept of cryptocurrency was introduced in 2008 when an anonymous entity or group known as Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This whitepaper outlined the core principles of a decentralized digital currency.

The Birth of Bitcoin

In 2009, the first cryptocurrency, Bitcoin, was launched. Bitcoin brought about a new era of decentralized digital currencies that operate on a technology called blockchain. Blockchain is a distributed ledger technology that maintains a secure and transparent record of all transactions.

Early Adoption and Growth

Bitcoin gained traction among tech enthusiasts and libertarians who saw its potential to disrupt traditional financial systems. Over time, more individuals and businesses started to accept Bitcoin as a form of payment, leading to its gradual mainstream adoption.

Altcoins and Blockchain Innovation

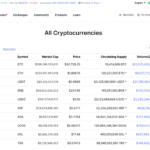

As Bitcoin gained popularity, alternative cryptocurrencies, also known as altcoins, began to emerge. These altcoins aimed to improve upon the limitations of Bitcoin and introduced innovative features. Some notable altcoins include Ethereum, Ripple, Litecoin, and Bitcoin Cash.

The ICO Boom

In 2017, Initial Coin Offerings (ICOs) became a popular method for fundraising in the cryptocurrency space. Startups and projects would issue their own tokens and offer them to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. This led to an explosion of new cryptocurrencies and increased public interest in the industry.

Regulatory Challenges and Market Volatility

As cryptocurrency gained mainstream attention, regulators around the world started to take notice. Governments implemented various regulations to protect consumers and prevent illicit activities. The market also experienced significant volatility, with prices of cryptocurrencies soaring and crashing in rapid succession.

Blockchain Beyond Cryptocurrency

While cryptocurrency remains the most well-known application of blockchain technology, its potential extends far beyond digital currencies. Blockchain is now being explored and implemented in various industries, including supply chain management, healthcare, and finance.

The Future of Cryptocurrency

The future of cryptocurrency is still uncertain, but there is growing interest and investment in the industry. Central banks are exploring the concept of central bank digital currencies (CBDCs) and major tech companies are developing their own digital payment systems. The evolution of cryptocurrency and blockchain technology continues to shape the future of finance and digital transactions.

Comparison of Cryptocurrency Alternatives

| Alternative | Definitive Features |

|---|---|

| Ethereum | Smart contracts, decentralized applications (dApps), and development platform. |

| Ripple | Real-time gross settlement system, currency exchange, and remittance network. |

| Litecoin | Faster block generation time, increased maximum supply, and different hashing algorithm. |

| Bitcoin Cash | Larger block size, faster transactions, and lower transaction fees compared to Bitcoin. |

FAQs

Q: Is cryptocurrency legal?

A: The legal status of cryptocurrency varies from country to country. Some governments have embraced it, while others have imposed restrictions or outright bans. It’s important to research and comply with the regulations in your jurisdiction.

Q: How secure is cryptocurrency?

A: Cryptocurrency transactions are secured using cryptographic techniques. However, the security of individual wallets and exchanges depends on the precautions taken by users and service providers. It is crucial to use reputable platforms and ensure the safety of your private keys.

Q: Can I mine cryptocurrency?

A: Mining cryptocurrency involves using computational power to validate transactions and secure the network. While it is possible to mine certain cryptocurrencies, such as Bitcoin, it requires specialized hardware and substantial energy consumption.

Q: How can I buy cryptocurrency?

A: Cryptocurrency can be purchased on specialized cryptocurrency exchanges using traditional fiat currencies or other cryptocurrencies. It is important to choose a reputable exchange and follow proper security measures for storing and managing your digital assets.

Conclusion

Cryptocurrency has come a long way since its inception, with Bitcoin paving the way for a decentralized financial revolution. As the industry continues to evolve, new cryptocurrencies and blockchain applications emerge, showcasing the transformative potential of this technology. However, with regulatory challenges and market volatility, it is essential to stay informed and exercise caution when engaging in cryptocurrency-related activities.