Main Highlights/Features

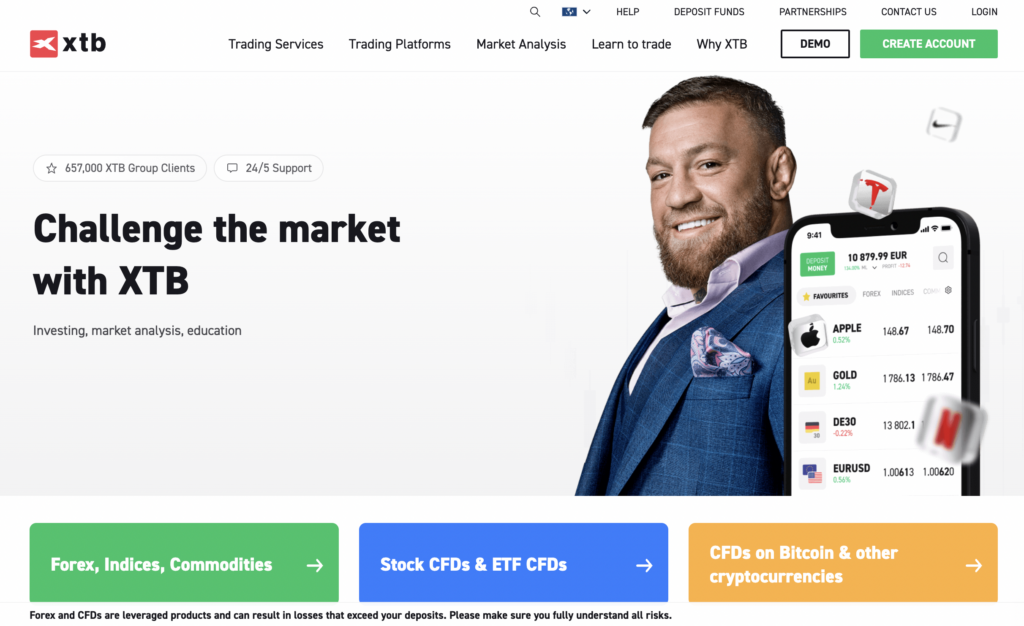

– XTB is a well-established broker with a strong presence in the trading industry

– They offer a wide range of tradable assets, including forex, stocks, commodities, indices, and cryptocurrencies

– The platform is user-friendly and offers advanced trading tools and features

– XTB provides access to a variety of trading platforms, including their xStation 5 platform and popular MetaTrader 4

– They offer competitive spreads and leverage options

– XTB provides a comprehensive education center, including webinars, video tutorials, and trading guides

– The broker offers a demo account for beginners to practice trading strategies without risking real money

– They have excellent customer support available 24/5 via phone, email, or live chat

Comparison Table vs competitors

| Features | XTB | Competitor A | Competitor B |

| Tradable Assets | Wide range | Limited range | Wide range |

| Trading Platforms | xStation 5, MT4 | Proprietary platform | MT4, MT5 |

| Spreads | Competitive | Average | Competitive |

| Leverage | Up to 1:30 | Up to 1:20 | Up to 1:50 |

| Educational Resources | Comprehensive | Limited | Comprehensive |

| Customer Support | 24/5 availability | Limited hours | 24/5 availability |

Summary Table of Features

| Features | Rating (out of 5) |

| Tradable Assets | 5 |

| Trading Platforms | 4.5 |

| Spreads | 4 |

| Leverage | 4.5 |

| Educational Resources | 5 |

| Customer Support | 4.5 |

Fees and Pricing Structure

XTB offers different types of accounts to cater to various trading needs. The fees and pricing structure vary depending on the chosen account type:

1. Standard Account:

– Minimum deposit: $250

– Spread: From 0.35 pips

– Commission: None

– Leverage: Up to 1:30

2. Pro Account:

– Minimum deposit: $25,000

– Spread: From 0.28 pips

– Commission: $3.5 per lot round turn

– Leverage: Up to 1:30

3. Islamic Account:

– Minimum deposit: $250

– Spread: From 0.35 pips

– Commission: None

– Leverage: Up to 1:20

Safety Features

XTB takes the safety and security of clients’ funds seriously. They implement various safety features, including:

– Fund Segregation: Client funds are kept separate from the broker’s own funds to ensure they are not used for any other purposes.

– Regulatory Compliance: XTB is regulated by multiple financial authorities, such as the Financial Conduct Authority (FCA) in the UK, ensuring compliance with strict regulations.

– Investor Protection: XTB is a member of compensation schemes, providing additional protection for clients’ funds in the event of the broker’s insolvency.

– Secure Technology: The broker employs top-notch security measures, including encryption and firewalls, to protect client data and transactions.

FAQs

Q: How can I open an account with XTB?

A: Opening an account with XTB is simple. You can visit their website and fill out the registration form. Once your account is verified, you can proceed with funding and start trading.

Q: What trading platforms does XTB offer?

A: XTB provides access to their proprietary xStation 5 platform and the popular MetaTrader 4 (MT4) platform.

Q: Can I practice trading with XTB before investing real money?

A: Yes, XTB offers a demo account where you can practice trading strategies using virtual funds.

Q: Does XTB charge any withdrawal fees?

A: XTB does not charge any withdrawal fees, but the receiving bank may have its own charges.

Conclusion

In conclusion, XTB is a reliable and reputable broker with a wide range of features and competitive offerings. Their extensive range of tradable assets, user-friendly platforms, and comprehensive educational resources make them an excellent choice for traders of all levels. XTB’s commitment to client safety and excellent customer support further enhances their appeal. While fees may vary based on the chosen account type, the overall value provided by XTB makes them a strong contender in the trading industry.