Litecoin has been a natural alternative to Bitcoin since 2011, with investors eager to participate due to the coin’s high potential value. Although the price of Litecoin has dropped dramatically in recent months, there are currently some encouraging signals that could lead to lucrative chances in the next months and years.

We’ll go over our Litecoin Price Prediction for a range of timeframes in this article. Our analysis will cover both technical and fundamental factors, assuring a rational prognosis – and we’ll also point you in the right direction to start buying Litecoin.

2023 Litecoin Price Prediction

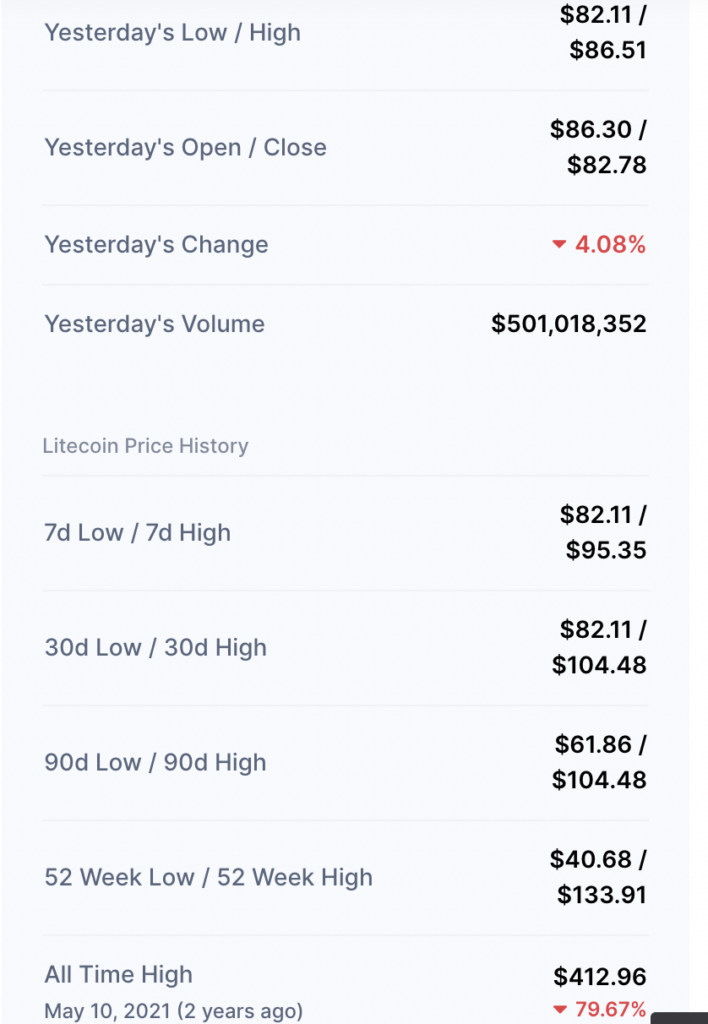

The upward trend in the LTC/USD price that began around the close of 2020 and continued throughout the following year will continued into April of 2022, the rise peaking around March at $131. A surge in the price of Litecoin was seen in 2021 when it reached its all time high of around $413. The price of Litecoin like other cryptocurrencies has seen a huge dip since 2021, experiencing an 79% drop since reaching an all time high in 2021. The current price of Litecoin in March 2023 is $83.74

Past Litecoin Price History

When purchasing cryptocurrency, it’s important to evaluate the past price data to predict the future price. With that in mind, this section will delve into the history of Litecoin’s price, examining how we arrived at this position. But first, let’s review what Litecoin is and how it functions.

Litecoin was created by Charlie Lee, a former Google employee, and published in 2011. Litecoin (LTC) is a peer-to-peer cryptocurrency similar to Bitcoin (BTC). Litecoin’s blockchain, on the other hand, features a faster block generation time, a greater maximum threshold of coins, and a distinct hashing mechanism.

Because of these distinctions, Litecoin has several real-world advantages over Bitcoin. Because of the shorter block production time, Litecoin transactions are a fraction of Bitcoin transactions, making the network faster. Furthermore, Litecoin’s hashing method is more user-friendly than Bitcoin’s complex mining technique, making mining more accessible to the average person.

Litecoin didn’t take off until May 2017, when it entered the spectacular bull market that saw the coin’s value climb by 3951 percent in only seven months. CNBC claimed that Litecoin was the fourth-largest cryptocurrency globally, with many investors eager to participate as a Bitcoin alternative.

However, from December 2017 and December 2018, the value of Litecoin plummeted by 93%. Much of this wasn’t due to Litecoin specifically but rather to the overall collapse of the crypto bubble. During this period, most digital currencies’ price charts will likely show large declines in value. Many investors thought cryptocurrency to be nothing more than a novelty.

As we have seen in the years, people don’t just buy Ethereum for the sake of speculation; they also acquire it for its practical applications. It is also true for Litecoin, which experienced a price surge in December 2020.

Also, as it reached $410, the price dropped dramatically. Again, much of this was an unintended consequence of China’s crypto mining regulations, which damaged Bitcoin and the entire cryptocurrency economy.

Litecoin Price Predictions

We considered both technical and fundamental components for our Litecoin price prediction during our investigation. This method ensures that our Litecoin projection is as accurate as possible, making more informed investment decisions. The sections below delve into the technical and fundamental variables influencing the LTC price, giving you a solid sense of the coin’s prospects.

To start of we will share a litecoin price prediction generated using algorthms by Coin Price Forecast:

| Year | Year-End |

| 2022 | $58.83 |

| 2023 | $65.43 |

| 2024 | $72.04 |

| 2025 | $85.04 |

| 2026 | $104.07 |

| 2027 | $122.72 |

| 2028 | $120.06 |

| 2029 | $113.51 |

| 2030 | $125.71 |

Technical Analysis

It’s critical to analyze the price chart and seek technical elements to provide insight into future price action, just as it is when buying equities. In the case of Litecoin, there was a massive jump in May 2021.

Price hit a high resistance level around $390, which prompted a significant bearish fall in the following months. However, in July 2021, the Litecoin price broke out of the descending wedge pattern, which forms when there is likely to be a significant increase in bullish momentum. In just a few weeks since that split, the price of Litecoin rose by roughly 70%.

We see some resistance around the $60 mark in our Litecoin forecast as we move forward. The coin is currently trading sideways between $50 and $60. The momentum is mixed as MACD Line is above MACD Signal Line which makes it bullish however the RSI(~ 50) is Neutral.

Fundamental Analysis

During our Litecoin price prediction, we also consider fundamental aspects. As previously stated, Litecoin is similar to Bitcoin as it can transfer value from one person to another. Many individuals believe that Litecoin is a better digital currency since it is speedier and has fewer fees than Bitcoin.

Litecoin is reasonably stable is one of its most enticing features. Again, this is all relative, but Litecoin has the lowest volatility compared to other coins. As a result, slightly more risk-conservative investors may prefer to include it in their portfolios over alternatives like Cardano, Dogecoin, or Ripple.

Lastly, Litecoin is a well-known cryptocurrency, with many businesses and sellers accepting it as a payment mechanism. The more partnerships Litecoin has, the more valuable the digital asset becomes. If the trend continues, the price of Litecoin will surely rise further.

2023 Litecoin Price Prediction

According to Litecoin projections, Litecoin may reach a price between $58 and $172 by the end of 2023 with the average most likely value being in the $100 mark.

2024 Litecoin Price Prediction

Based on historical data, Litecoin’s price prediction foresees at least $97 per coin ranging from $97-$172, given many people’s recent acceptance of Litecoin and other cryptocurrencies. Investing in a pool may prove to be a wise decision in the long run.

Litecoin Price Forecast 2025

Over the long term, our Litecoin forecast is fairly positive. Litecoin has been in existence since 2011, making it one of the first cryptocurrencies to reach the market. It is a plus for Litecoin because it is well-known, making it more attractive to prospective partners. Furthermore, because there is so much price data, forecasting future changes is easier.

Litecoin has an 84 million LTC maximum supply, compared to 21 million for Bitcoin, according to Sygnum. Although Litecoin has less volatility than other cryptos, the higher supply makes it far more stable. Another compelling argument for purchasing Litecoin is the lower barriers to entry for Litecoin miners compared to other cryptos.

Our Litecoin forecast for 2025 is fairly optimistic in terms of the future. As more businesses use Litecoin as a payment mechanism, the coin’s image in the crypto industry will undoubtedly improve. The resulting ‘hype’ will help drive up the price if this happens. We anticipate this will happen in the next few years, with Litecoin reaching atleast $180 by 2025.

These projections are from our analysis; therefore, they differ from elsewhere.

Litecoin Price Chart

As we’ve seen in our Litecoin forecast, the crypto’s future seems bright. Although it lacks Bitcoin’s ‘brand appeal,’ it performs far better in terms of technological performance. The developers of Litecoin must now focus on translating this into improved market performance.

One of the primary reasons investors aren’t as enthusiastic about Litecoin as Bitcoin is that Litecoin founder Charlie Lee sold all of his LTC holdings during the December 2017 significant increase. As a result, many people believe he utilized the coin for personal benefit, discouraging investors.

If Litecoin can break free from this stereotype, it will gain more legitimacy and see its price rise. Litecoin has partnered with some major companies, including the UFC and the Miami Dolphins, according to Publish0x. If the creators can add more companies to their list of partners, the coin’s valuation will skyrocket.

What are the Best Places to Invest in Litecoin?

As this article has demonstrated, Litecoin appears to be a promising investment in the future. This coin has lower volatility and more stability than many other cryptos, making it appealing to low-risk investors. To invest in Litecoin, you must first create an account with one of the best trading platforms that supports it such as eToro and other major exchanges such as Binance and CoinBase.

After conducting extensive research and testing, we discovered that eToro one of the leading sites for investing in Litecoin, especially for beginners. The FCA, ASIC, and CySEC regulate eToro, guaranteeing all users’ safety while trading. Furthermore, eToro boasts a global user base of over 20 million people, which adds to the platform’s trustworthiness.

The best part about eToro is that there are no commissions to pay when trading. Whether it’s a cryptocurrency or another asset, eToro has a 0% fee structure, making it an extraordinarily low-cost location to invest. Furthermore, there are no deposit or monthly account fees with eToro.

The minimum deposit amount at eToro has been cut to just $50 (£37), allowing customers to start small and gradually increase their investment. You can make deposits via credit/debit cards, bank transfers, and various e-wallets. PayPal is one of the e-wallets on this list, and it is a popular choice among investors.

Lastly, eToro provides some useful tools, like CopyTrader and CopyPortfolio. CopyTrader users can automatically imitate transactions made by other eToro users, while Copyportfolio users can invest in professionally managed portfolios without paying any management fees. Combining these two features makes eToro one of the most trader-friendly platforms accessible today.

Will the Price of Litecoin Increase?

Litecoin has been the leading asset over the last decade, establishing itself as a trusted brand for investors and traders. It has earned a reputation in all markets for which it has worked tirelessly and nonstop.

The world’s largest digital currency manager, Grayscale Investments, has received FINRA approval to launch a Litecoin Trust, opening up Litecoin to high-net-worth individuals and institutional accounts, thereby instilling confidence in the retail and institutional investment community.

As a result, the long-term outlook for Litecoin price prediction appears promising, as the cryptocurrency is ready to integrate privacy protocols and partners.

What are the factors that influence the Litecoin’s price?

As we have said, Litecoin predictions are just rough predictions of future Litecoin price. Many external factors can alter the Litecoin prices in both directions, which affects the Litecoin forecasts.

Litecoin allows you to distinguish between factors that only influence the Litecoin market price and factors that have the potential to influence the entire cryptocurrency market, including Litecoin.

Factors that affect the Litecoin Price

- In cooperation with Flare Networks, introduction of smart contracts

- Technical developments in Litecoin include planned data protection upgrades

- Hacker attacks and technical disruptions

- Collaborations with large companies or projects (NFT/DeFi, banks and PayPal, etc.)

Factors that influence the crypto markets

- Regulations from the state

- Adaptation to cryptocurrencies

- Hacker attacks on exchanges

- Blockchain technology has new applications

- Changes in the global financial system

- Events around the world such as corona virus

- A bear market, as in 2022 and 2018

- FOMO

Conclusion on Litecoin Price Prediction

To summarize, Litecoin is a viable option to Bitcoin that puts it in an ideal position to gain from future market impacts. Furthermore, numerous payment systems now (and will continue to) accept Litecoin as part of their services, increasing the coin’s accessibility. If Litecoin can continue to introduce new features that set it apart from the competition, we could see big price gains in the future.

So, if you want to buy Litecoin right now, we recommend eToro. Due to FCA and ASIC regulations, eToro is one of the safest places to acquire cryptocurrency. Furthermore, when it comes to crypto trading, eToro doesn’t charge any commissions and accepts investments as low as $50.

FAQs

What is the current Litecoin price?

The current Litecoin price is $52.66.

What factors influence the price of Litecoin?

The overall movement largely influences the price of Litecoin in the crypto market. When the value of other cryptos and altcoins rises, it tends to have a blow effect on Litecoin. On the other hand, as the value of cryptocurrencies falls, the value of Litecoin tends to fall as well.

What is the ideal place to purchase Litecoin?

Many brokers list it as a trade-able asset because Litecoin is among the top 20 cryptos in market capitalization. However, we advocate investing in Litecoin through eToro, which is highly regulated and has a 0% commission structure on crypto investments.

Why is the price of Litecoin Decreasing?

Litecoin is now falling due to the crypto market’s being in an overall bear market. As the value of most coins decreases at present, Litecoin’s value also follows the general market and is likely to recover with the rest of the major cryptocurrencies when the bull market returns.

What will the value of Litecoin be in 2023?

According to our calculations, Litecoin is likely to end up in a range of $50-$89 by the end of 2023.

What will the value of Litecoin be in 2025?

There will almost certainly be another big price drop in the coming years. How ever like in the past it is highly likely that the coin will once again recover, reach at least its previous all time high when the crypto bear market ends. It is even more likely the coin will surpass its previous all time high before correcting and settling at a higher average price than the current price.