- Bitcoin

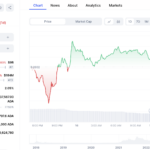

(BTC) - Price $94,269.00

- Market Cap

$1.87 T

| Name of the Project | Bitcoin |

| Ticker | BTC |

| Total Supply | 19,231,587 |

| Launched | January 2009 |

| All Time High | $68,789.63 |

| Official Website | bitcoin.org |

| Market dominance | 38.69% |

| Market rank | 1 |

In order to make a valid Bitcoin forecast (BTC), we have examined Bitcoin facts and figures in this article. In 2022, there were over 180 million bitcoin wallets and the number of daily transactions has surpassed 400,000 in Jan 2021. Over 18,000 businesses take cryptocurrency as payment.

In November 2021, Bitcoin reached an all-time high of $68,000. Bitcoin is currently worth around $20,300. This represents a significant decrease. It is not uncommon for the price of a cryptocurrency to plummet after reaching an all-time high, only to rise again and surpass the previous all-time high. This occurred in December 2017, when bitcoin reached an all-time high of above $19000. Then it crashed, ushering in the crypto winter. When strong bull markets are followed by a long bear market, this is what happens in crypto markets.

Current Bitcoin Sentiment in April 2025

The current sentiment in the Bitcoin market is bullish, with a sentiment score of 77 according to CoinCodex. Additionally, the Bitcoin Fear and Greed index is at 78, indicating a sentiment of “Extreme Greed” in the BTC market.

Please note that sentiment can change rapidly, especially in the world of cryptocurrency. Therefore, these values should be considered as a snapshot of the current moment and not as a prediction of future sentiment.

Bitcoin Fundamentals and Environment in 2024

The current Bitcoin environment is characterized by a mix of corporate adoption, political implications, and significant energy consumption concerns.

Corporate Adoption: Bitcoin has seen increased acceptance among corporations, with companies like MicroStrategy and Tesla investing heavily in it. MicroStrategy, for instance, has adopted Bitcoin as its primary reserve asset, amassing a large portfolio of the cryptocurrency. This shift marks a notable change in perception from just a few years ago, when Bitcoin was viewed skeptically by many in the business world.

Political Implications: Bitcoin is becoming more intertwined with politics, particularly after El Salvador adopted it as legal tender. This move has sparked discussions in other countries about the potential for similar adoption. However, there’s also been a pushback from some nations, with China cracking down on Bitcoin mining and trading, illustrating the complex and varied global stance on cryptocurrency.

Energy Consumption: A major concern surrounding Bitcoin is its significant energy consumption, with reports indicating that each Bitcoin transaction requires enough electricity to power an American home for six weeks. This has led to criticism about the sustainability of Bitcoin mining, which relies heavily on electricity. The debate is ongoing, with some pointing out that the Bitcoin network is increasingly using renewable energy sources, while others highlight the competition this could create for energy resources in other sectors.

Market Outlook: Despite these challenges, market analysts remain optimistic about Bitcoin’s price potential. 10X Research predicts a rally that could see Bitcoin’s price reaching $70,000 by the end of the year, supported by macroeconomic factors, monetary policy, and increasing interest from traditional finance sectors.

Price and Market Cap: As of the latest data, Bitcoin’s price is $53,571.72, with a 3.95% increase over the past 24 hours. This puts Bitcoin’s market capitalization at approximately $1.05 trillion, reflecting its significant impact on the financial market and its status as a leading cryptocurrency.

Overall, the Bitcoin environment is dynamic, with significant investment and adoption on one hand and environmental and regulatory challenges on the other. The cryptocurrency’s future will likely be shaped by how these issues are addressed, alongside the evolving landscape of global finance and technology.

Current Bitcoin Price Development and Market Dynamics

The current Bitcoin (BTC) market is showing signs of activity and interest from investors. As of the latest updates, the price of Bitcoin is approximately $53,571.72, reflecting a recent uptick of about 3.95%. This movement places Bitcoin’s market dynamics in a position of recovery and potential growth, following periods of volatility.

Market dynamics and sentiment around Bitcoin are also influenced by global events and regulatory shifts. For instance, countries like El Salvador have adopted Bitcoin as legal tender, while others like China have imposed restrictions on cryptocurrency operations, affecting mining and trading activities. Despite regulatory challenges in some regions, the global hash rate contributions indicate a resilient and distributed network of miners, with the United States and China being significant contributors.

Investors and market watchers are closely monitoring the impacts of ETFs (Exchange-Traded Funds) on Bitcoin’s price and market cap. Recent reports highlight substantial inflows into spot BTC ETFs, signaling a growing institutional interest in cryptocurrency as an asset class. This development, along with anticipation around changes in U.S. Federal Reserve interest rates, could influence Bitcoin’s market dynamics moving forward.

Overall, the Bitcoin market is experiencing a phase of cautious optimism, with signs of both recovery and ongoing challenges. Investors and enthusiasts continue to navigate the market’s complexities, keeping a close eye on regulatory developments, technological advancements, and broader economic indicators that could impact the cryptocurrency space.

What are the factors that influence the Bitcoin price prediction?

Many internal factors influence the Bitcoin (BTC) price, but also external ones.

There are many market factors that can cause BTC’s value to rise or fall, in addition to internal factors like announcements about updates, halving, and network security.

External changes can be regulations or bans. This was most evident recently with China’s imposing severe restrictions on cryptocurrency.

The supply/demand ratio is also affected by public acceptance and sentiment. Bitcoin’s value will increase if more people and companies believe in it.

Our BTC forecast also includes the growing competition on the most well-known and oldest cryptocurrency. Other cryptos like Polkadot, Solana, and Ethereum can be used in many other areas, but this can also change the investment ratio for altcoins.

Bitcoin price forecast to the end of 2024

The Bitcoin forecast for 2024 is varied, with several experts and analyses predicting different outcomes based on current trends, historical data, and expected market developments. Here’s a summary of the key predictions and analyses:

- CoinCodex provides a bullish outlook, suggesting Bitcoin’s price could significantly increase. It also mentions the Bitcoin Fear & Greed Index standing at 72, indicating a current market sentiment of “Greed.” Their forecast is based on technical indicators and historical performance, suggesting a profitable investment in Bitcoin currently.

- Cointelegraph discusses the potential impact of the Bitcoin halving event, expected before April 2024. A commentator from BitQuant predicts Bitcoin could surpass its previous peak and potentially reach a new all-time high before the halving, with a post-halving target around $250,000, based on Elliott Wave charting and previous cycles.

- CoinDesk highlights the significance of 2024 due to expected ETF approvals and the halving event, suggesting these factors could reshape the dynamics of digital assets and potentially lead to a pivotal year for Bitcoin.

- Money.com discusses why some crypto experts predict Bitcoin could soar to record highs in 2024, attributing part of the potential growth to the improving overall economy and other macroeconomic factors. The article reflects on the comeback Bitcoin and the crypto industry have seen, with values rising significantly over the past year.

- Reuters reports that Standard Chartered has raised its Bitcoin forecast for the end of 2024 to $120,000. The bank’s analysis suggests increased miner profitability per Bitcoin mined could lead to reduced net Bitcoin supply and push prices higher. The report also mentions the upcoming halving event, which is expected to further reduce the daily Bitcoin supply.

These forecasts suggest a generally bullish outlook for Bitcoin in 2024, with significant milestones such as the halving event and potential ETF approvals expected to play critical roles in shaping the market. However, as with any investment, there’s inherent risk, and predictions can vary widely based on unforeseen market developments and external factors.

Medium-term Bitcoin forecast – 2025

We believe that Bitcoin (BTC), will continue to mature and increase in value, usability, and security over the next few decades.

Experts worldwide have estimated that the average BTC price will be between $50,000 and $100,000 by 2025. We consider this a valid estimate. The next Bitcoin halving will take place in 2024. This could lead to a shortage of bitcoin and therefore cause an increase in the price.

This value is not fixed and may change depending on market conditions worldwide.

Bitcoin Forecast 2025

- Walletinvestor.com: Bitcoin is predicted to reach $87,702 by 2025.

- DigitalCoinPrice – Compared to 2024 DCP forecasts a price US$52,325.

- Longforecast.com – According to Longforecast.com, the price of the house will be $49,900 by 2025.

- CryptoGround: According to CG, in 2025 the price of one Bitcoin will be $97,361 US.

Long-term Bitcoin forecast – 2030

It is likely that Bitcoin (BTC), will become a market-place digital currency. The Taproot upgrade, and the second layer Lightning network may also be technological developments that could help Bitcoin scale.

Additionally, NFTs and play-to-earn are seeing strong growth. Bitcoin will continue to grow in virtual spaces such as the Metaverse.

Ark Invest recently calculated a BTC value in USD 1m for 2030. Experts even believe it to be over USD 5m.

This assessment is a bit optimistic for our Bitcoin forecast. However, we would love to see it rise by 2030.

Additional Bitcoin price predictions for 2030

- WalletInvestor predicts the Bitcoin price until August 2027. Their predicted price is between $69 721 and $97 037 by August 2027.

- CoinPriceForecast predicts BTC to reach $76,591 at the end of 2030.

- Gov.Capital predicts that BTC will reach $236,328 in September 2027.

- Cryptoground uses algorithms and analysis to predict bitcoin’s value at $109,786 in 2027.

What Famous People Say about Bitcoin Price:

Steve Wozniak – Apple cofounder Steve Wozniak has said he expects the bitcoin price to eventually hit $100,000, calling the interest in crypto “so high.” “I think bitcoin is going to go to $100,000,” Wozniak said while speaking on the Wild Ride with Steve-O.

In march 2022 Elon Musk said ““I still own & won’t sell my Bitcoin, Ethereum or Doge fwiw.” This is after the prices of crypto were plummeting. Having bought $1.5billion worth of crypto in 2021. In July Tesla offloaded 75% of its bitcoin. Tesla is a public company so all the decisions are not just up to Elon Musk, unlike normal retail investors they may not be able to HODL and risk losing large sums of money.

Some people were upset Elon Musk went against his word and may have influenced people to buy crypto, his response was “I have never said that people should invest in crypto. In the case of Tesla, SpaceX, myself, we all did buy some Bitcoin, but it’s a small percentage of our total cash assets.”

“I really like Bitcoin. I own Bitcoins. It’s a store of value, a distributed ledger. It’s a great place to put assets, especially in places like Argentina with 40 percent inflation, where $1 today is worth 60 cents in a year, and a government’s currency does not hold value. It’s also a good investment vehicle if you have an appetite for risk. But it won’t be a currency until volatility slows down.” – David Marcus (Former President of Paypal)

How to invest in Bitcoin

First of all to invest or buy Bitcoin you need to find a reputable cryptocurrency exchange, open an account, fund the account with fiat currency then purchase bitcoin.

Here are 3 of our recommended platforms to buy bitcoin:

| Exchange | Features |

| Binance | Binance has a global presence and supports over 80 cryptocurrencies. They also support margin and futures trading. With the inception of DeFi, Binance now supports staking in addition to charging lower fees. |

| Coinbase | Coinbase supports over 50 cryptocurrencies you can start trading right away. They have also launched DeFi services and now offer staking to their users. They are licensed to operate in the U.S., making them an obvious choice for traders in this location. |

| eToro | When it comes to supported cryptocurrencies, eToro trails the likes of Binance and Coinbase as they only support a handful of digital assets. The best thing about eToro is that it is not only a trusted crypto exchange but its an investment platform where you can trade stocks, CFDs and ETFs. |

Open a Binance account now and start investing in cryptocurrencies as well as other assets classes.

Trading Bitcoin Using bots:

Don’t miss out on great buying and selling opportunities while you sleep. With the help of crypto bots, you can trade without emotion and make profitable trades 24/7.

Crypto Bots integrate via APIs to your chosen exchange and change on your behalf using the trading strategies that you choose or set up.

Top 3 Bitcoin trading bots on the crypto market:

3Commas – Connects to 13 of the top exchanges including Binance, Kraken and Kucoin. Has a free plan so you can test it out before trading with larger amounts of money.

Coinrule – Allows you to create custom rules or use templates. Supports 10 plus exchanges including Binance and Coinbase Pro.

Cryptohero – Can manage multiple accounts. Supports all the major Bitcoin exchanges such as Binace, Kucoin and Coinbase Pro. Can run up to 30 bots on the pro plan.

Here’s a quick overview of Bitcoin – When was it created and why?

In January 2009, Bitcoin (BTC) launched its Genesis Block. The open-source project was founded by Satoshi Nakamoto, an unknown group or individual.

The goal of Bitcoin is to allow users to store and transfer money to other people without relying on centralized third parties such as financial institutions or governments. Individuals should be in complete control of their assets.

Bitcoin, which debuted in 2009, has gotten a lot of attention. Its ability to compete with VISA and other global payment options has been lauded.

The first setback occurred after bitcoin’s value had risen almost continuously for the previous five years. The network’s limited capacity gradually became apparent as a problem.

Since then, scalability has been a hot topic. During the bull run, transaction fees skyrocketed, making Bitcoin less appealing. Fees as high as $40 USD made smaller transactions unprofitable, particularly in micropayments.

Bitcoin solved the Segregated Witness problem (SegWit). The SegWit network upgrade went into effect on August 23, 2017. This upgrade significantly increased the capacity of the Bitcoin blockchain and elevated it above other high-throughput blockchain technologies.

In addition, Bitcoin was the first blockchain to employ the Lightning network for second-level scaling. The Lightning network is frequently regarded as the second half of the solution to Bitcoin’s scaling issues, which were first addressed by SegWit.

Bitcoin fundamental development and other factors that impact the price

We want to assess which fundamental factors positively affect the Bitcoin price before we get into current Bitcoin forecasts.

These qualitative factors cannot be quantified in numbers. These factors are also distinct from chart-technical variables, which are more relevant to short-term periods.

Instead of being used to forecast the bitcoin price in the medium to long term, our qualitative factors should be understood.

Adaptation

The most important factor in Bitcoin’s success is its adaptation as an underlying asset, as well as BTC itself – primarily as a store of value.

Bitcoin has had many successes over the years that have had an impact on the overall situation. Particularly, the Bitcoin network has seen tremendous growth in recent years.

Metcalfe’s Law, which is used for valuing networks, states that the squared user base is the measure of network value.

The example of Bitcoin illustrates the network effect

A strong growing network leads to a significant increase in value which favors existing network participants.

While there is an increase in Bitcoin investors, it’s mainly the companies that drive infrastructural developments that play a part. Here are the best crypto exchanges such as Coinbase and companies that create their own products using the network.

We want to highlight the importance of companies like Square and PayPal, which accept Bitcoin as a payment method. You can also buy Bitcoins using PayPal. The positive adaptation of the technology was also made possible by Tesla, which accepted Bitcoin to pay for vehicles and services. This option is currently suspended by the electric car manufacturer.

Institutional and private market demand

The demand for Bitcoin is another factor that directly impacts adaptation. Bitcoin is a rare resource. There can only be 21 million BTC. In other words, rising prices are inevitable when there is a greater demand for this scarce resource.

The private demand has significantly influenced the Bitcoin price since its inception in 2009. But, there is a paradigm shift. Bitcoin is being bought by more institutional investors. Some examples include Grayscale, MicroStrategy and Square, as well as MassMutal.

Institutional analysts are now accepting Bitcoin as an investment vehicle. As a result, there will be more scarcity. This is due to the fact that these investments are made at the corporate level with a long-term outlook.

Regulation

Regulation is also a significant contributor to the creation of value. This fact is often exaggerated because large networks such as Bitcoin make regulation difficult due to their decentralised nature. A complete ban is also possible.

However, unanticipatedly strict regulation could also have a negative effect on the bitcoin price growth.

Here is the recent example from Turkey, which wanted to ban Bitcoin in order to maintain stability of its Turkish lira. Investors will find it harder to invest in an asset if it is banned. This is a chance for other countries to be more open.

However, there has been a lot of progress in regulation over the past few years. The legal position for Bitcoin investors in Germany, for example, is very clear. Clear case law is also available in important countries, such as the USA.

Bitcoin Price FAQ

- Why is Bitcoin price falling?

As with any asset, cryptocurrencies are subjected to the market mechanism of supply and demand. Accordingly, Bitcoin (BTC), if there is less demand, then the price will also fall. There are also uncertainties due to bans, regulations, conflicts, and bans from governments like China. The growing competition is another important factor. Altcoins are becoming more important and could replace Bitcoin as a store-of-value. - How high can Bitcoin price rise?

As a digital asset, Bitcoin (BTC), is hard to value. Experts’ opinions are not as divergent in Bitcoin (BTC) than they are for any other asset. There are also many external factors that can strongly impact the value of cryptocurrency in general. We assume that cryptocurrencies will adapt and will eventually become mainstream. A price mark of $100,000 or more is possible by 2030.

Bitcoin Price Forecast: Conclusion

From November 2021 to December 2022, the bitcoin price dropped from $68,000 to around $16,993.34. This is however the normal cycle in crypto markets. Bull markets that drive the first crypto to new heights, followed by bear markets that wipe out up to 80% of the currencies value. We know from history that Bitcoin rises after bear markets. This is why we shouldn’t be surprised. Experts believe that bitcoin will continue to grow and recover. Many experts believe that bitcoin will recover and grow to a value of over $100,000. By 2030, some even predict that the first cryptocurrency could be worth more than $200,000. Bear markets are a great time to be in on the action, while there’s still blood on the streets. This could be an opportunity to earn 3X or more in returns. Even if bitcoin prices increase to their previous highs, you can still get 3X your investment. The history of crypto shows that the first cryptocurrency Bitcoin always recovers and surpasses its all-time high after a major drop in price during a bear market.