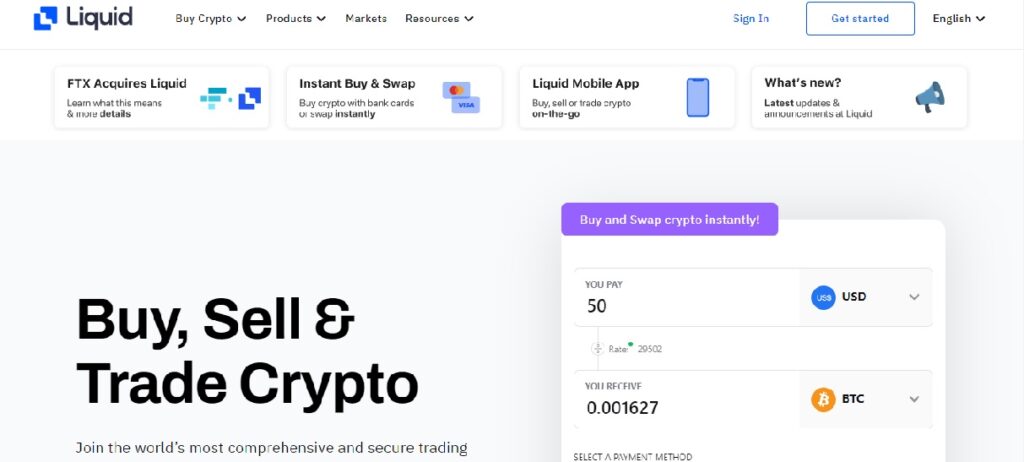

Liquid, a cryptocurrency exchange, was launched in January 2014. Although it has an office in Singapore, the Japanese FSA (Financial Supervisory Authority) regulates and licenses Liquid. It allows trading in a number of cryptos (174 trading pairs as of the 20th of December 2018, when this review was first written).

As of 26 October 2021, its subsidiary QUOINE Corporation has been registered in Japan as a Type 1 Financial Instruments Business. They will now offer cryptocurrency derivative trading services to Japanese customers, following this registration.

Liquid Cryptocurrencies

Over 100 cryptocurrencies are supported by Liquid. It has one of the most extensive lineups among all crypto exchanges. It supports many fiat currencies, including the U.S. Dollar, Euro, and Japanese yen.

Here are some things to note. There are many cryptocurrencies available on Liquid, but not all of them can be purchased with fiat money. Only a third can be bought with U.S. Dollars for Liquid’s cryptocurrency offerings. You can only trade for many of them with another cryptocurrency like Bitcoin (BTC), Tether (USDT), or other cryptocurrencies.

Even though Liquid supports many cryptocurrencies, there are still some major names. You won’t find Polygon or Cardano, two of the most well-known cryptocurrencies on this exchange.

Fees

Liquid’s fee structure is efficient as it lowers trading prices and encourages traders to engage with customers. Trading fees are charged based on the trade volume. Trading fees are waived for transactions made through QASH. Referral discounts are also offered to its traders, which improves their relationship. Liquid charges 0.3% per month, which is reduced based on trading volume. For traders who trade less than $10,000 per month, the platform waives any fees.

While withdrawals and deposits are free of charge, Liquid charges a fee of 0.1% for fiat transactions. Liquid understands the importance of charging low fees for cryptocurrency withdrawals. For Ethereum, withdrawals cost 0.01ETH and bitcoin is currently at 0.0007BTC. Liquid accepts different payment methods. You can pay via bank deposits or credit cards. However, there may be higher fees.

Liquid Deposit Methods

Liquid allows wire transfers. It does not accept credit card deposits. Liquid, which is an FIO-enabled platform that accepts deposits from addresses other than credit cards, may be the first such platform. Depositing crypto to an exchange requires that you type a series of letters and numbers. There is always the chance of entering incorrect or missing a number. A deposit address of 40 characters can be mistyped and the crypto sent to the wrong address. Users can now register their FIO deposit addresses starting 13 January 2021. This works just like an email address and allows for a hassle-free and safe deposit handle.

Liquid Withdrawal Methods

It is usually time-consuming to withdraw crypto currencies. It is important to do extensive research before trading. Fiat withdrawals can take up to three working days, while digital assets may take two business days after the request is submitted.

Supported Currencies and Countries

Liquid accepts a variety of fiat and cryptocurrency to be competitive with global market leaders. Below is a list of cryptocurrencies and fiats that Liquid accepts:

- USD

- EUR

- JPY

- AUD

- HKD

These are the accepted cryptocurrencies:

- BTC

- ETH

- IOTA

- XRP

- LTC

Liquid can be purchased in most countries with some exceptions. It is not available in the USA.

Liquid Mobile Support

Are you looking to track your cryptocurrency investments and trade on your smartphone? Liquid Pro App is the app that this exchange offers. This app allows you to access most of the trading platform’s features without requiring a desktop computer.

Liquidity

According to Coinmarketcap.com, the 24-hour trading volume was USD 182 million at the time of this review’s last update (2 December 2021).

US Investors

US-investors can only trade crypto-to-crypto here (and not fiat -to-crypto). Legality is the main reason US-investors are not allowed to trade fiat-to-crypto. Many companies that accept funds from US-investors are subject to obligations under the US-legal system. These obligations include, among others, the obligation to prepare marketing material according to SEC-standards, and register them with SEC (a tedious process).

Liquid Trading View

Different trading views are available on different exchanges. There is no one “best” view. It is up to you to decide which trading view suits you best. The common features of all views are that they show the order books or at least a portion of them, the price chart for the chosen cryptocurrency, and the order history. They usually have sell and buy-boxes. You should take a look at the trading views before you make a decision about which exchange to choose.

Customer Support

Liquid has a very user-friendly digital help section that contains many articles to answer frequently asked questions. They also offer an email support service, which usually responds to queries in a matter of hours. Reviews indicate that trading on Liquid has been a positive experience. One concern is that smaller altcoins don’t perform as well as larger cryptocurrencies. It also has an academy that shares knowledge. Traders can also get support via email, phone and virtual. The platform has received positive customer support reviews.

Advanced Trading

The key to any financial transaction is advanced trading. For better decision-making, traders need to be able to comprehend the market and risks. Liquid’s interactive website and constant customer support make advanced trading easier. This makes it easier to make the right decisions. Advanced trading can be done using a professional interface which allows traders to fully understand the market and the value of assets.

Pros and Cons

| Pros | Cons |

| Trading fees are low | Unavailable in the U.S. |

| Trading options for beginners and professionals | Expensive withdrawal fees |

| Get rewards from our lending program | Missing major cryptocurrencies |

| More than 100 cryptocurrencies supported | |

| Excellent security |

Conclusion

Liquid is an excellent cryptocurrency trading platform for fintech traders. It is a great choice for all traders, from novices to professionals. It needs to improve its trading fees and professional support tools. There is always room to improve, as the race to be the most compact and viable cryptocurrency exchange platform isn’t over. It is a great choice because it conforms to all key financial regulations and rules.

Liquid’s corporate infrastructure is one of its greatest advantages. It allows for fair trading. It is actually one of the first to verify FIO deposits. This is a great strategy by the organization, as it will help streamline the exchange of crypto currency. It is a smart decision to join Liquid, which will allow you to trade effectively in financial markets. However, one should always review your choices before making an investment.