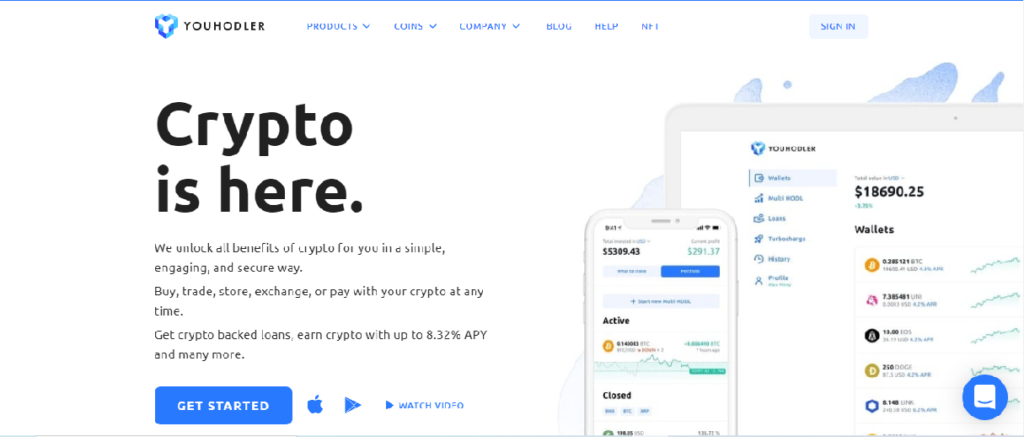

YouHodler, a crypto exchange and lender, pays high interest rates for crypto deposits. It is not available in the U.S. and could be more transparent about risks, rates and fees. Customers can use crypto to secure short-term loans and borrow funds to trade advances. To find out if YouHodler could be of benefit, read this review.

What YouHodler has to offer

YouHodler is available for those who want to borrow crypto currency or earn a high interest rate on their cryptocurrency.

The high-interest rate is due to crypto loans being funded by depositors. The platform offers more than 30 top cryptocurrencies, including ADA and BTC, BCH and BNB as well as DASH, ETH. LTC, XLM. XRP. HT.

YouHodler’s digital wallet can be used to store any coins a customer would like to earn interest in. The wallet also supports fiat and crypto currencies. YouHodler’s mobile application allows you to use the wallet.

Earning interest in crypto

The only way for cryptocurrency investors to make a profit is if the price of the coin they hold goes up. To capture this gain, however, you will need to sell your crypto.

Also, you can’t buy and hold standalone crypto. You need to find an exchange that pays you interest if you want this.

YouHodler can help you do this by lending your crypto to them. It can lend your crypto to earn anywhere from 3% to 15%. The minimum balance to earn interest is $100. Interest is compounded every week.

How to apply for a loan at YouHodler

These are the steps for requesting a loan from YouHodler:

- You have many options to apply for a loan in Bitcoin or fiat. They can also use the different altcoins they have as collateral to get the initial loan. For more information, you can visit the top BTC loan websites.

- First, apply online for a loan and pledge their crypto portfolio assets. Instantly, the user will receive the agreed loan amount in fiat currencies. This can be in EUR, GBP or USD. They can get their collateral back after the loan has been repaid. This is true even if the value of the collateral has changed.

- YouHodler makes it easy to get a loan. YouHodler makes it easy to get a loan. Once the user confirms that they have an account and have provided collateral, the first step will be complete.

YouHodler Loan Terms & Amounts

According to YouHodler’s review, it offers a variety of loans that the user can choose from with their own terms and conditions. There are three loan terms available: 30 days with a LTV at 90%, 60 days with a LTV at 70%, and 180 with a LTV 50%.

The type of loan selected by the user determines the interest rate, not the amount of collateral provided by the user. All users have the same interest rate. One can also predict that as the community grows, the interest rates will drop. YouHodler offers an affiliate program. This encourages others to invite you through referral links, and allows you to earn crypto simultaneously.

Fees

Bank wire withdrawals are subject to a 5% fee and credit card withdrawals require a 3.5% fee. Crypto loans can also attract fees.

- Close now fee – 1% off the overdraft amount

- Reopen – Interest Fee + 1% Service Fee (from the borrowed amount).

- Extension of PDL – 1.5% additional collateral

- LTV increase – 1.5% of the greater amount

A profit share fee will be applied to any Multi HODL deals that make a profit. This fee was 0.45% in one example YouHodler provided. We couldn’t confirm if this fee is what traders pay for profitable deals. A service fee will be charged if your Multi HODL trade falls under the purview of a margin call. We were unable to find any explanation of how the fee is calculated.

It is also not clear what YouHodler users pay to convert/buy currencies. The company announced that it would be introducing market pricing rates, which will be “executed using a most accurate market rate.”

YouHodler promised that the change would result in lower fees for its customers. YouHodler also offers a calculator that shows you the conversion fees and the total amount you would receive for each crypto or fiat. We would still prefer a clearer and more transparent fee structure.

Pros and Cons

| Pros | Cons |

| Earn interest with your crypto | It is not available in the U.S. |

| Borrow against your crypto | Transparency is lacking |

| Advanced trading tools | Loans with high APRs |

Is YouHodler safe?

YouHodler offers all the security features you would expect from a user-level system, including TFA (two-factor authentication). Customers who have more than $10,000 in their accounts may disable all withdrawal options to increase security.

It keeps its customers’ assets in a mixture of cold and hot wallets. Although it doesn’t specify how much is kept offline in cold stock, YouHodler has a deal with Ledger Vault, digital asset security specialists. This means that private keys are encrypted and secured, and cannot be accessed by this lender’s staff.

Ledger Vault protection also provides $150 million in insurance against crime pooled to protect customers in case of theft or fraud. The insurance will not cover funds of customers in the event that an exchange fails, just as it does with many other crypto exchanges. FDIC insurance protects money in savings accounts against bank failure, but not crypto platforms.

YouHodler also stated that it is a member of the Blockchain Association, which offers dispute resolution. There may be recourse for clients who feel let down by YouHodler.