Many people look for financial assets to make instant profits and invest. Most people stumble upon cryptocurrency while on their search. The biggest source of profit in recent years has been cryptocurrency assets. Despite the decline in cryptocurrency markets in 2021, people continue to search for better ways of managing their digital wealth and trading them.

Many crypto investors no longer look for cryptocurrency exchanges to manage trades. They are instead looking for crypto asset management solutions that can be connected to multiple exchanges and offer a wide variety of crypto coins. Quadency is a popular asset management platform in the crypto space. Quadency allows you to harness the power of automated trading robots for all your exchange accounts.

This Quadency review will cover different aspects of this platform. This article is based on Quadency reviews that are reliable and helps you understand the trading strategy of this platform. This Quadency review is intended to provide investment advice. It will show you how to keep your trading accounts connected and make profitable crypto investments.

What is Quadency?

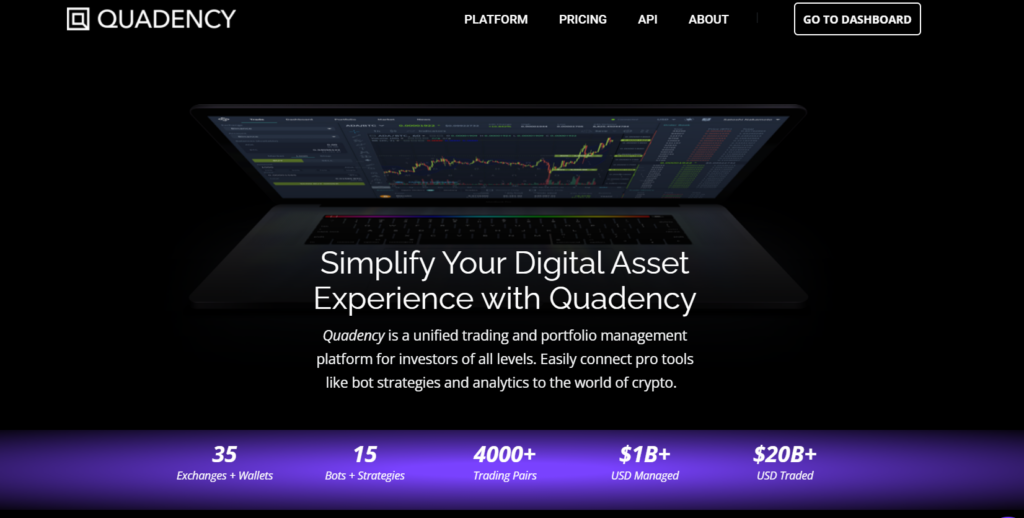

Quadency is an online platform to manage crypto assets. Quadency is an online platform for managing crypto assets. It allows users to connect multiple exchange accounts. Quadency’s crypto trading platform combines these accounts to create a single interface that allows for seamless asset management.

Quadency provides a seamless trading experience. Quadency’s crypto trading platform features a user-friendly interface, robust platform security, and a simple user-friendly interface.

Quadency is not only for beginners, but it also assists professional crypto traders. Quadency provides powerful tools for crypto currency trading to aid in technical analysis and market developments. It provides an intuitive crypto charting platform that generates insight-driven reports about crypto trading and portfolio management.

Quadency supports exchanges

Quadency is compatible with many exchange platforms and allows trading chart integration. Quadency supports the following exchanges:

- Binance

- Bitfinex

- Binance US

- Coinbase Pro

- Kraken

- OKEx

- Kucoin

- HitBTC

- Liquid

- Gemini

- Poloniex

- Bittrex

Quadency can easily be extended with fully-automated trading capabilities of Binance, Kucoin and other exchanges.

Quadency Pricing

Pricing depends on what you do on the platform. Register today to get a free account. The Quadency platform sets a $10,000 monthly trading limit. Quadency charges live support fees for upgrading or accessing Unified REST & Streaming API. Quadency Pro is a $49.00/month service subscription that unlocks these features. Quadency Pro can also be purchased at $39.99 per monthly with an annual plan. Quadency Unlimited is also available for $99 per month, while Quadency LITE is completely free.

Quadency: How secure is it?

Quadency can connect to your exchange accounts via APIs. You can trade on any exchange’s platform using Quadency. Quadency does not ask you to share your withdrawal access. This means that your funds will never be withdrawn from your account without you consent and that you can only withdraw manually.

Quadency bot also uses Transport Layer Security to ensure its website works through the Hypertext Transfer Protocol Secure. This encrypts the data you send to trading solutions servers and makes sure your information cannot be tampered with.

Two-factor authentication (2FA), is used by the trading tool to increase account security. It also operates in compliance with the OWASP Top 10, document standards, for maximum security of its web applications.

Quadency is also required to pass penetration testing by third-party vendors in order to make sure that its systems comply with the latest security standards.

It is easy to use.

It’s very simple and straightforward. All your regular trades will be possible as we move.

How to open a Quandency account

- Register

Create an account on Quadency. - Connect Exchange

Your API keys will allow you to link your account with any of the supported exchanges. Although the process is slightly different depending on which exchange you use, it is generally the same. - Trade Bot and Create Orders

You can now place an order on Quadency or create a bot to trade on the chosen exchange.

Bots & Strategies

Quadency has many features that can be used to create a precise and specialized trading strategy.

The offer, as mentioned above, is broad enough to include low-risk general strategies that are suitable for both newcomers and niche bots that industry veterans can adapt to their needs and exploit certain market tendencies.

The following bots are on the list:

Portfolio Rebalancer

This portfolio will help you diversify your portfolio. You can choose any asset and add it to your portfolio. The bot will automatically purchase and liquidate assets according to your portfolio allocation whenever they move. This bot can help you convert multiple assets into one asset such as Bitcoin.

Grid Trading Bot

This bot automates “grid trading”, which seeks to make money from market volatility by placing multiple limit orders on grid lines surrounding the current price. Filled orders that move up or down within the grid are replaced automatically with the appropriate buy/sell orders to continue trading.

Market Maker Bot

The trading bot allows you to place simultaneous limit orders on both the buy and sell sides of your order book. Once both stop-loss orders have been triggered or the orders are fulfilled, the process is repeated and two more orders are placed automatically. Market-making is another name for this strategy.

Smart Order

This trading bot allows you to go long or short, placing smarter orders that have trailing stop-loss targets and fixed profit targets. The bot sends market orders to monitor your stop-loss target and profit target, and uses hidden orders to do so in real time. Once the position has been closed, the bot stops automatically.

TradingView Bot

Webhooks can be used to integrate your TradingView account and Quadency. You can then execute your customized strategy by creating alert conditions based upon your TradingView account’s signals. This trading bot will be supported by multiple actions, which is another goal of the team.

Multi-Level RSI

This allows you to accumulate assets when they fall below RSI levels. It also helps with dollar-cost averaging, which means you can buy more if the price falls further. When the profit target or stop-loss level is met, it sells.

MACD

This bot uses the MACD trading indicator. The bot buys assets when the MACD indicator crosses above the signal level and sells when it crosses below the signal limit.

Mean Reversion

This simple RSI-based strategy buys assets if they are below the “oversold”, RSI level and sells them when they are above the “overbought”.

Accumulator

This trading bot allows you to buy or accumulate assets over time at a certain price. This bot is useful when you want to buy large quantities of assets, or implement Dollar-cost Averaging (DCA).

Your own trading strategy

Quadency lets you create your trading bot with Python programming language if none of these strategies work for you. To execute any multi-exchange or multi-market strategy, you can create event-based (real time) or candle-based algorithm.

Quadency Review: Conclusion

Quadency is, in our opinion, one of the most popular platforms in 2021. It is legitimate and distinguishes itself from other cryptocurrencies exchanges.

Pros.

- All-in-one cryptocurrency trading platform

- Automated trading robots

- Visual portfolio manager.

- This platform is the ideal choice for new traders because of its intuitive UI.

- This platform makes it easy to set up crypto asset management.

- You will find many trading strategies within the library.

Cons

- There is no mobile trading app.

- Quadency does not offer margin trading strategies.

Other crypto trading bots:

Read reviews about other legit trading bots that we have reviewed: TradeSanta, Coinrule & Zignaly