Shrimpy can be used to balance your portfolio and is also a social trading platform. It provides a responsive customer support, unique features, an interactive user interface, and unique features. Shrimpy allows users the ability to build custom cryptocurrency index funds as well as copy trading strategies. Users can even automate their rebalancing. The tool currently supports 30 of the most popular crypto exchanges, with new ones being added all the time. Copy Trading and Social Trading are its distinctive selling points. But is Shrimpy secure? This Shrimpy Review will review its pricing, operation, features, and many other aspects.

What is shrimpy, exactly?

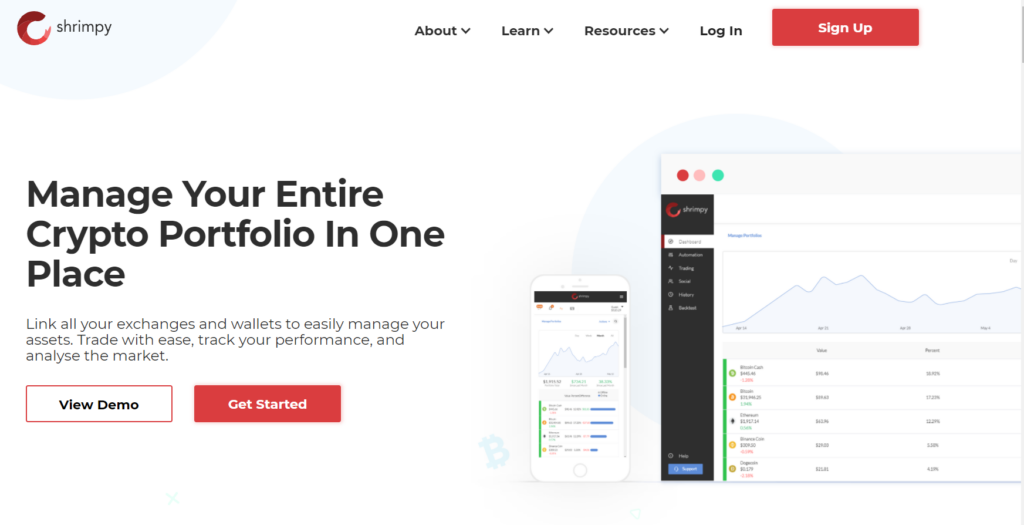

Shrimpy was launched in 2018 as an automated trading system for trading cryptocurrency. It features predefined signals and automated functions. This platform is web-based and can be accessed easily via the Shrimpy site.

Shrimpy gives traders control over their portfolios and allows them to automate. It can also index and analyze cryptocurrency markets.

Backtesting, which allows you to see how your strategy will perform before you implement them on this platform, is another feature.

All users who wish to use this platform must sign up and connect the API to an exchange account. Then, they can immediately trade using the system.

This bot is one the most social cryptocurrency trading platforms. You can get suggestions and strategies from other users to make your trades more profitable.

What’s Shrimpys Reputation?

Shrimpy is a trading bot service that can be compared with other services. While it doesn’t seem to be widely known in crypto, the platform has a lot of potential. This trading bot platform is slowly but surely gaining momentum with day traders, both experienced and novice.

How does Shrimpy work?

Its functionality is the most popular reason why customers look for Shrimpy app reviews. The app is famous for providing automated portfolio rebalancing. It’s the process of realigning an asset’s weight within a portfolio. It involves buying and selling assets gradually to maintain the desired risk/asset level. The platform promised to make trading easy for both new and experienced crypto investors.

Customers can even use the service to copy top traders’ strategies and social trading strategies via Copy Trading & Social Trading. The service is completely free and helpful for new traders. Experiential traders can benefit as a copy of their portfolio strategy will earn them 4 dollars per calendar month. Shrimpy is free for holders. Professionals must pay 13 USD per month to have an annual plan.

It allows you to collaborate investing with tools like index automating. The platform is easy to use and the functionalities it offers make up for the price. It is this reason that most professionals choose the platform over other options.

What Exchanges Does Shrimpy support?

Here’s a listing of some supported exchanges.

- Huobi

- Gemini

- Binance

- Bibox

- Bitfinex

- Coinbase Pro

- Bittrex

- Bitstamp

- Bitmart

- Bittrex International

There are no restrictions on the cryptocurrency trades via these exchanges.

Shrimpy Pros And Cons

| Pros | Cons |

| The tool as well as the crypto bots are completely free. | It does NOT offer crypto signals. |

| Multi-functional trading platform that offers increased security. | Financial security can’t be guaranteed 100%. |

| Users can use social trading tools to duplicate successful trading strategies. | Referral program only has limited validity |

| Portfolio automation rebalance. | No trading terminal |

| Provides educational guides regarding digital currencies. | Does not offer trading robot scripting. |

| Simple to understand, and simple to use | No mobile app for users. |

| Multi-currency exchange support to manage your cryptocurrency. | |

| A demo account can be used by traders to manage and test their portfolios. | |

| Support for dollar-cost average and threshold rebalancing |

Shrimpy Features

Shrimpy features a lot of wonderful features. These include Portfolio Management, Trading Automation, Social Trading, and Trading Automation. Below are details about each feature as well as the sub-features.

Portfolio Management

Although trading crypto was once all about it, portfolio management has become increasingly important to crypto traders looking to be long-term investors. Shrimpy offers excellent portfolio management and increased risk management. Shrimpy’s automation features and ability to interact are great additions.

Shrimpy is unique as a portfolio manager tool. It does not use indicators or trading signals, and doesn’t manage user portfolios. Rather is uses automation and the basic risk management strategies of rebalancing and dollar-cost-averaging to keep portfolio risk in check. It also provides performance tracking to monitor how your investments are doing.

Shrimpy allows you to build your own crypto index with the parameters of the built-in smart Indexing tool. This gives traders access to index funds and performance tracking.

Shrimpy provides a social trading feature called “social copy trading” that allows users to follow the strategies and trades of other traders on the platform. This feature is as simple to use as a click on the platform. Shrimpy will then automate each trade made by the trading manager.

Index Funds

Shrimpy, as mentioned, has its own built in indexing tool that allows users to create and maintain their own index. Shrimpy’s indexing tool features a range of parameters that make it the most powerful tool in crypto portfolio software. It is possible to create an index and also to weigh it.

This index consists of 26 cryptocurrencies and is weighted based on market capital. Maximum allocations for any asset are limited to 20%. Image via Shrimpy blog.

Shrimpy lets you create an index either manually, automatically, or based on market capital-weighted or equal-weighted indices. After that, users choose a rebalance date for their newly created crypto index portfolio.

Performance tracking

Multiple exchange accounts can make it difficult to track your performance. Shrimpy’s intuitive dashboard makes it easy for you to monitor your portfolio’s performance across all supported exchanges. Without this tracking, you can only guess at your profitability. Shrimpy is used by the top traders to aid them in making important trading decisions.

Portfolio Automation

Shrimpy’s integrated trade algorithm makes it simple to automate your portfolio. Shrimpy makes it easy to automate your portfolio, unlike other crypto-based solutions. It doesn’t use complex indicators or statistics, but Shrimpy does. It employs long-term strategies like portfolio rebalancing, dollar-cost-averaging, and portfolio-cost averaging to keep your portfolio in balance and under control.

Portfolio Rebalancing

Shrimpy’s main automation feature is portfolio rebalancing. This is how the software helps you reduce risk and improve your profit margins. The tool is automated and can be used to create a positive environment for profiting from market movements.

Portfolio rebalancing doesn’t seem to be a new concept. It’s been used for decades by equity traders. It’s becoming increasingly popular with mature crypto traders, who also find it useful in managing their portfolios. Portfolio rebalancing involves buying and selling assets, in order to achieve a certain target allocation. Shrimpy makes these trades automatically to ensure that the portfolio is at the desired percentages.

Two options are available for users to rebalance their accounts:

- Threshold-rebalancing – This strategy involves rebalancing the portfolio when an asset moves beyond the allocation by a predetermined amount. This type can result in higher trading costs as it often triggers more trading event.

- Periodic Rebalancing – This simple technique looks at your portfolio at regular intervals (monthly/weekly, daily, etc.). and rebalances the portfolio to meet the defined asset percentages. If periodic rebalancing is done on a weekly, or more frequent basis, trading fees can be kept under control. However it can increase market risks.

Backtest

Shrimpy includes a back testing tool which allows you to assess whether an index fund or strategy would have performed well over the years. You can review the past five year’s data to see how any custom-made strategy, index, or portfolio performed. This information can be used to help you develop a profitable trading strategy with Shrimpy.

Social Trading

Shrimpy’s social trading feature is another distinctive feature. Anyone can use this feature to copy trades from “lead” traders and possibly make some profit. Shrimpy does not share indicators and signals like other platforms. Instead, it is focused on the community of traders who use the platform. Traders can become leaders, create groups of traders who are like-minded, or just follow the trades they choose.

By following trades from more experienced traders, a new trader can still build his portfolio. Automating the entire process allows them to keep their portfolios up-to-date whenever the portfolio of a trader they follow changes. Shrimpy makes trading strategies of successful traders simple to follow.

You can earn $4/mo for every user that implements the trading strategy by creating groups. Now, you can have 10 followers and earn $40/mo. Aim to have 100 followers and earn $400/mo. For traders who succeed, there are no limits to their potential rewards.

Shrimpy’s social-trade feature allows you to start trading cryptocurrency. They can be more profitable and learn from the trades done by the successful traders that they are following.

Pricing Shrimpy

There are different pricing options available on Shrimpy.io. The Starter price is $19 per monthly for spot trading. Connects to 5 Exchanges, automates 3 Accounts, and requires a 15-minute refresh.

The $79/month professional package includes five-minute refresh options, connections to 10 exchanges, 5 accounts automation, and optimization with rebalancing. Futures trading is soon available to this plan.

Enterprise plans are $299 per Month and include 1-minute balance refreshing, 10 account automatons, connecting up to 25 exchanges, priority help, and a server.

These plans offer lots of options and are reasonably priced. However, these plans do not offer access to additional features or access such as linking with more than 30 exchanges.

Shrimpy Review: Conclusion

Shrimpy is a great tool, but novice investors won’t find many reviews and testimonials about Shrimpy because it’s so new. This makes it difficult for novice investors to make informed decisions about using the cryptocurrency trading bot. But ultimately, each person can choose what they want. Other cryptocurrency trading robots can be found with similar features as shrimpy. These include bitsgap, zignaly, quadency, coinrule and 3commas.